The story of Facebook’s origins is widely known. Mark Zuckerberg’s encounter with Tyler and Cameron Winklevoss marked the beginning of a legal battle that would become legendary. The twins approached Zuckerberg with their social network idea, seeking his assistance as the developer. However, instead of collaborating, Zuckerberg secretly embarked on his own venture while leading the Winklevoss twins on. Upon discovering his betrayal, the twins took legal action, accusing Zuckerberg of stealing their concept.

Following the legal dispute, the Winklevoss twins, often referred to as the Winklevii, were presented with a settlement offer of $65 million from Facebook. Their legal counsel strongly advised accepting the sum. Surprisingly, the Winklevii declined the cash offer, opting for payment in Facebook stock. This decision baffled their lawyers, who urged them to take the money and move on. However, for the Winklevii, it was not solely about the financial gain. Coming from a wealthy background, they recognized Facebook’s enormous potential and desired a stake in its future success.

Choosing stock compensation over immediate cash proved to be a wise move for the Winklevii. When Facebook went public with its IPO, the value of their shares skyrocketed, reaching an astounding half a billion dollars. Nevertheless, this triumph came at a cost: their public battle against Zuckerberg tarnished their reputation. The media portrayed them as spoiled and entitled, casting them as mere opportunists trying to profit from Zuckerberg’s accomplishments. In contrast, Zuckerberg was hailed as the ingenious mind behind Facebook. As he succinctly put it, “You weren’t the first people to have an idea for a social network, and neither was I. Friendster and MySpace existed before Facebook, and the last time I checked, Tom from MySpace isn’t suing me.” This highlighted the significance of execution rather than just having an idea.

The Zuckerberg Effect

Despite the mixed public perception, the Winklevii found themselves with an abundance of wealth after the legal battle. With $500 million at their disposal, they faced a crucial decision—how to utilize their fortune. While many would opt for extravagant luxuries, the Winklevoss twins had a different vision. They aimed to shed the image of “dumb jocks” and redefine their legacy. Their plan was to invest in other companies, demonstrating their business acumen and actively participating in the entrepreneurial landscape. Thus, they set their sights on Silicon Valley and embarked on a journey as angel investors, seeking startups with the potential to surpass even the success of Facebook.

However, an intriguing pattern began to emerge. Each time the Winklevii expressed interest in investing in a particular company, their offers were consistently rejected. While occasional rejections are expected, the frequency of these declines raised eyebrows. Curious about the reasons behind these refusals, the twins confronted one of the founders, asking, “We’ve presented a compelling offer. Why are you turning down our investment?” Surprisingly, the root of the problem once again led back to Mark Zuckerberg.

In the fast-paced realm of Silicon Valley, founders once dreamt of selling their businesses to Facebook or forging strategic partnerships with the tech giant. However, an intriguing narrative emerged surrounding the Winklevoss twins, where their association became an undesirable prospect for aspiring entrepreneurs. Mark Zuckerberg’s stance on avoiding any dealings with the twins rendered their money and presence toxic within the industry. This realization left the twins uncertain about their future, plunging them into a disheartening predicament. Determined to break free from the shadows, they embarked on a transformative journey, and it led them to the enchanting island of Ibiza.

Embracing Uniqueness and Opportunity

On a fateful night in Ibiza, the Winklevoss twins found themselves immersed in a vibrant club scene, desperately attempting to escape the weight of their recent challenges. However, their minds remained consumed by thoughts of their next strategic move. They yearned to carve a path that would leave a lasting impact and showcase their true potential. The club atmosphere failed to offer solace; instead, it intensified their contemplation. Recognizing their discomfort, the twins decided it was time to depart. Yet, as if fate had intervened, a voice suddenly called out, “Hey, are you the Winklevi?”

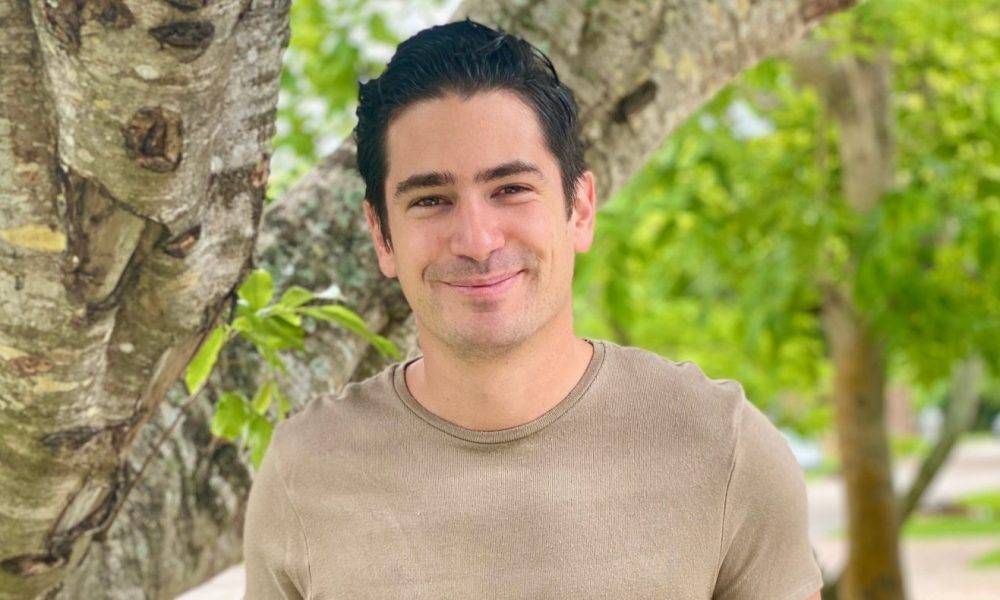

One of the downsides of being six-foot-five twins who’ve just been portrayed in an Oscar-nominated movie is that it’s pretty hard not to stand out. The guy introduced himself as David Azar and said he needed to tell them about something. “And what’s that?” one of the twins asked. David took a dollar bill out of his pocket, and with a smile, he said, “A revolution.”

Intrigued by the Possibilities

Standing on a beach in Ibiza, David captivated the attention of the Winklevoss twins with his passionate discourse on a groundbreaking technology known as Bitcoin. Surprisingly, the twins had not encountered Bitcoin before, which was not uncommon considering its recent emergence. The encounter took place in 2012, three years after Bitcoin’s inception in 2009. As David eloquently conveyed his ideas, the twins found themselves torn between dismissing Bitcoin as nonsense or recognizing its immense potential.

With utmost clarity, David delineated, “Bitcoin represents a digital currency, an entirely decentralized electronic cash system that eliminates the need for intermediaries such as banks, Visa, and Mastercard. Moreover, the total supply of Bitcoins is strictly limited to 21 million, preventing governments from indiscriminately printing more money as they do with cash.”

Considering the recent bank bailouts following the 2008 market crash, the twins could readily perceive the advantages of a decentralized monetary system. Additionally, David revealed that Bitcoin’s mysterious creator, Satoshi Nakamoto, had published an extensive white paper detailing this revolutionary peer-to-peer digital currency. However, shortly after this revelation, Satoshi vanished without a trace, leaving the world puzzled. Furthermore, Satoshi’s claim of being Japanese while demonstrating flawless English proficiency added to the enigma, leaving his true identity concealed to this day.

BitInstant: Simplifying Bitcoin Transactions

Intriguingly, David sought investment opportunities for a company called BitInstant, aiming to facilitate easy Bitcoin purchases for individuals. The concept was simple: users would exchange regular fiat currency with BitInstant, which would then send them Bitcoin in return, charging a nominal commission fee. David’s eagerness to involve the Winklevoss twins stemmed from their potential as investors in BitInstant. The company’s founder, Charlie Shrem, operated the business from his mother’s basement, which initially did little to instill confidence in the twins. Nevertheless, the twins found solace in the fact that someone genuinely valued their involvement in a venture for once.

The unexpected discussion about Bitcoin had thrown the Winklevoss twins off guard during their Ibiza escapades. Nonetheless, they remained captivated by the sheer potential of this digital innovation as David passionately expounded upon its impact on the world. Having majored in economics at Harvard, the twins swiftly recognized that Bitcoin possessed not only the characteristics of a currency but also the attributes of a store of value—a digital incarnation of gold.

The allure of gold as a currency throughout history can be attributed to its durability, portability, difficulty to counterfeit, ease of authentication, and its scarcity. These characteristics have made it valuable, without being excessively rare. Interestingly, the Winklevoss twins discovered that Bitcoin possessed these very same attributes, and in fact, excelled in certain areas. Bitcoin proved to be easily divisible into smaller fractions and facilitated seamless transfers. However, unlike gold, Bitcoin lacked tangible backing, relying solely on perceived value and the willingness of individuals to invest in it. Nevertheless, this reliance on trust mirrors the foundation of any traditional currency. Motivated by these observations, the Winklevoss twins felt compelled to explore this innovative realm further.

Unveiling the Dark Side of Bitcoin and its Potential

After exchanging contact details with David, the Winklevoss twins embarked on a comprehensive exploration of the world of cryptocurrency. Their research revealed that Bitcoin had acquired a somewhat dubious reputation by 2012. It was largely associated with illicit activities such as drug deals, money laundering, and tax evasion. Admittedly, these perceptions were not unfounded. Bitcoin had also gained significant popularity among libertarians, who sought a decentralized financial system immune to government intervention. Nevertheless, the twins discovered that the technology itself was groundbreaking, and Bitcoin had amassed a steadfast community of supporters.

Recognizing the immense potential that Bitcoin held, the twins believed that widespread awareness and understanding were crucial for its success. They stumbled upon an interesting fact: the first recorded instance of Bitcoin being used for a real-world purchase occurred in May 2010. A Florida resident, craving pizza, offered to transfer 10,000 Bitcoins to anyone willing to order and deliver the desired pies to his address. The transaction proved successful, although hindsight now reveals it as a bittersweet victory. At the all time high value of a single Bitcoin, reaching $68,789.63, those ten thousand Bitcoins would have amounted to a staggering 680 million dollars. However, at that time, the future of Bitcoin remained uncertain. Nonetheless, the Winklevoss twins were resolved to become active participants in this evolving landscape.

Taking the Leap: Becoming Early Adopters and Investors

To manifest their dedication, the twins first decided to invest in BitInstant. They allocated approximately $1.5 million dollars to secure ownership stakes within the company. However, their ambitions surpassed mere investment. They urged Charlie to purchase one hundred thousand dollars’ worth of Bitcoin for themselves. Given that Charlie typically dealt with orders amounting to a few hundred dollars, this request was monumental. Astonishingly, a few days later, the twins requested another one hundred thousand dollars’ worth of Bitcoin, with additional orders pouring in thereafter. In due course, the Winklevii amassed around one percent of all Bitcoins in circulation, equivalent to roughly 200,000 coins. These acquisitions were made when Bitcoin’s price languished below $10 per coin. Fortunately for the twins, unforeseen events on a small island were poised to transform their fortunes and the trajectory of Bitcoin forever.

The Cyprus Incident: A Catalyst for Change

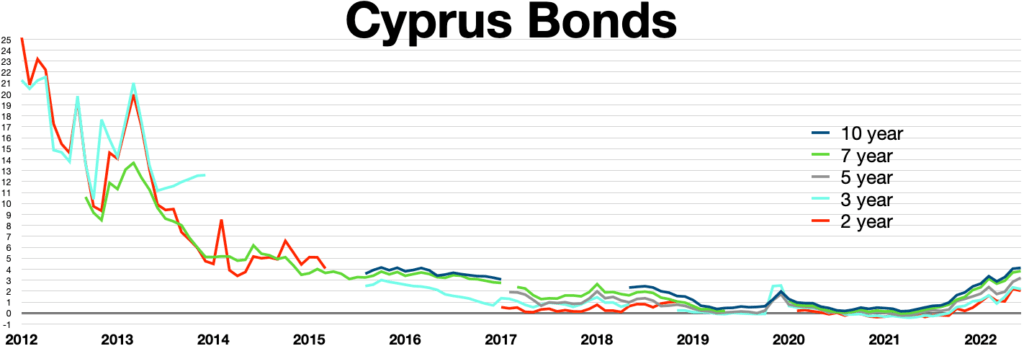

The banks in Cyprus found themselves in a precarious situation due to a series of ill-fated investments. One such investment involved loaning a substantial amount of money to Greece. Unfortunately, when the Greek economy plummeted, the banks compounded their losses by purchasing additional bonds from the Greek government. As a consequence, the banks in Cyprus were left financially devastated. Desperate for a solution, Cyprus sought a bailout from the European Union (EU). However, the EU offered assistance on the condition that Cyprus contribute a portion of the required funds. To fulfill this obligation, Cyprus resorted to an unprecedented measure: seizing funds from its own citizens. Consequently, if you were a resident of Cyprus during this tumultuous period, you would have awakened to discover that a portion of your bank balance had been taken to alleviate the country’s debt burden.

When the Winklevoss twins caught wind of this gripping story, they recognized its global significance. The incident served as a stark reminder of the inherent flaws in centralized systems, where governments and banks possessed unrestrained authority. People began to yearn for an alternative, a secure store of value impervious to government interference. Consequently, as news of the Cyprus incident reverberated worldwide, the price of Bitcoin commenced its meteoric rise, an ascent that appeared unrelenting. From $100 per coin to $500 per coin, and eventually soaring to a staggering thousand dollars per coin, Bitcoin garnered attention from one news outlet to another. Each publication fueling the fire, causing more individuals to become acquainted with the revolutionary potential of Bitcoin.

During this period of surging interest in Bitcoin, the Winklevoss twins emerged as fervent advocates for the cryptocurrency, traversing the globe to promote its merits. Nonetheless, they believed that Bitcoin needed to embrace a certain level of regulation to gain wider acceptance. They recognized the necessity of establishing regulatory measures without stifling the innovation that defined Bitcoin. Their vision entailed distancing Bitcoin from its murky associations and introducing more oversight within the crypto space.

Clash of Ideals: The Winklevii vs. Bitcoin’s Early Adopters

Unfortunately, the Winklevoss twins’ call for regulation did not resonate with many of Bitcoin’s early adopters. These individuals believed in the core principle of Bitcoin: complete freedom to manage personal finances without governmental intervention. They staunchly opposed any form of oversight, viewing it as a betrayal of the fundamental ethos underpinning Bitcoin. Consequently, a palpable conflict ensued between the Winklevii and some of Bitcoin’s initial proponents.

Interestingly, even within BitInstant, the company in which the Winklevoss twins had invested, there existed a lack of trust towards them. Some members of the organization perceived the twins as outsiders, disconnected from the true essence of Bitcoin, and prepared to litigate against anyone who disagreed with them. At the time, Charlie, the company’s founder, dismissed these concerns. However, he would later come to regret this dismissal when the Winklevoss twins decided to take legal action against him.

The Emergence of BitInstant

BitInstant quickly gained immense popularity as the demand for Bitcoin surged. With the increasing interest in Bitcoin, people were eager to acquire this digital asset, and BitInstant positioned itself strategically to cater to their needs. At that time, the dominant Bitcoin exchange was Mt. Gox, a website that originally operated as a platform for the card game Magic: The Gathering. However, Mt. Gox was plagued with inefficiencies, lacked regulations, and was managed by a peculiar Frenchman residing in Japan, who arrogantly claimed the title of “King of Bitcoin.” Engaging with Mt. Gox required a lengthy process of wiring money internationally, enduring weeks of account approval, and enduring further delays for deposit and withdrawal transactions.

BitInstant seized the opportunity by presenting itself as the intermediary in the Bitcoin market. They established a system where they purchased Bitcoin in large quantities from Mt. Gox and facilitated easier and faster transactions for individuals seeking to acquire Bitcoin. This business model proved highly successful. Moreover, with the financial support from the Winklevii, who recognized BitInstant’s potential, the company witnessed unprecedented growth. BitInstant’s transaction volume skyrocketed from a million dollars monthly to approximately a million dollars per day. Remarkably, BitInstant accounted for around 35% of all Bitcoin purchases during that period.

The Pitfalls of Success

Unfortunately, success can sometimes cloud one’s judgment, and this was the case for Charlie. As the company flourished, Charlie found himself captivated by a life of indulgence, traveling the globe, and mingling with models. Consequently, his CEO responsibilities suffered as a result. Understandably, this sudden fame and fortune were overwhelming for Charlie, who had been overlooked during his high school days. Now thrust into the limelight within the crypto space, he was determined to savor every moment. Gone were the days when he resided in his mother’s basement—he now felt invincible.

While Charlie reveled in his newfound stardom, the Winklevii held a different perspective. They recognized that if Charlie didn’t regain control soon, BitInstant would face significant challenges. Despite processing substantial Bitcoin transactions, the company itself was yet to achieve profitability. Moreover, Charlie approached the Winklevii for additional funding to manage escalating costs. Internally, the company seemed chaotic, with Charlie, barely in his twenties and lacking managerial experience, struggling to maintain order.

Tensions between the Winklevii and Charlie escalated in the following months. The twins diligently organized meetings with influential figures in the finance industry to promote wider adoption of Bitcoin. On one crucial occasion, they invited Charlie to join them to discuss BitInstant. Regrettably, Charlie appeared at the meeting hungover or possibly still intoxicated—an utter mess. His presentation faltered, leaving a lasting negative impression.

Frustrated by Charlie’s behavior, the Winklevii contemplated the unthinkable: replacing him as CEO of BitInstant. In a blunt conversation, they urged Charlie to abandon his partying lifestyle and prioritize the management of the business. Charlie, however, dismissed their concerns, believing that the company was thriving, making their intervention unnecessary.

Looking back, Charlie must have regretted not heeding the Winklevii’s advice. Merely a year later, he would find himself behind bars, his freedom abruptly snatched away.

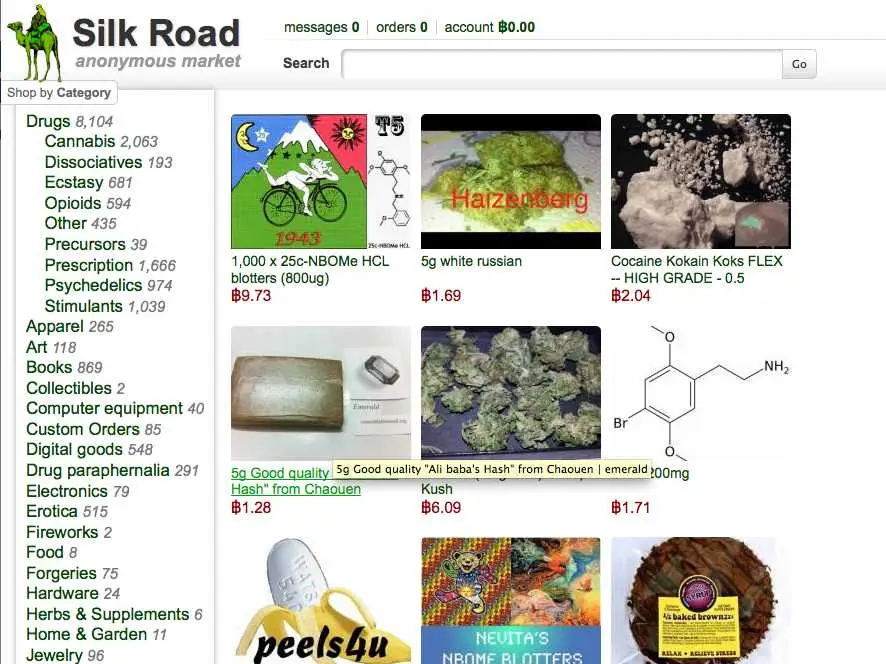

The Silk Road: An Underground Amazon of Illicit Trade

The Silk Road, a notorious online black market, thrived as an underground Amazon, facilitating the exchange of illegal goods ranging from drugs to firearms and even hired assassins. Acting as a multi-million-dollar enterprise, it relied on Bitcoin as its primary currency. However, the law finally caught up with the Silk Road’s owner in 2013, leading to its abrupt shutdown and the subsequent ripple effects throughout the Bitcoin market. The aftermath was nothing short of catastrophic, as the price of Bitcoin spiraled downward, causing a significant decline in the net worth of the Winklevoss twins, prominent Bitcoin investors. Yet, amidst the chaos, the twins saw an opportunity to acquire more Bitcoin, firmly believing that the demise of Silk Road would eventually prove beneficial for the cryptocurrency. Bitcoin’s reputation had suffered due to its close association with the illicit activities of Silk Road, tainting its perceived legitimacy.

Charlie’s BitInstant and the Unforeseen Obstacles

However, another unexpected blow befell the Winklevoss twins. The company they had invested in, the BitInstant, suddenly faced closure. The Silk Road debacle had repercussions beyond the notorious marketplace itself. BitInstant had lost its license, which granted it the status of a legal money transmitter. Consequently, Charlie, one of the founders, had no choice but to shutter the business immediately. While he attempted to reassure customers on the BitInstant website, claiming the situation was temporary, the twins knew all too well that the company’s fate was sealed.

The Turning Point: Charlie’s Arrest and Legal Battle

In January 2014, Charlie’s world crumbled even further. While innocently going about his business at an airport, he found himself unexpectedly apprehended. Handcuffed and led away by officers bearing badges from the FBI, IRS, and DEA, Charlie realized the seriousness of the situation and was filled with dread.

Charlie faced a barrage of inquiries from law enforcement officers regarding the BTC King, a user synonymous with Silk Road activities. Charlie made a chilling realization that this arrest was connected to Silk Road. BitInstant had a highly active user who had purchased approximately one million dollars’ worth of Bitcoin, likely destined for Silk Road’s illicit transactions. As the compliance officer, it was Charlie’s responsibility to report any suspicious activities, which he failed to do. In fact, he had conducted off-the-books transactions in an attempt to circumvent legal requirements. Charlie’s personal belief was that he should not question the motives or actions of Bitcoin users. However, legally speaking, he was obligated to do so.

Consequently, Charlie found himself facing charges of conspiracy to commit money laundering, failure to report suspicious activity, and operating an unlicensed money transmission service. He became the first person to be arrested directly due to Bitcoin, earning him the unfortunate title of the first Bitcoin felon. His face appeared prominently in the news, causing tremendous distress for Charlie and his family. To secure his release, Charlie’s parents were compelled to use their house as collateral. He was then placed under house arrest until his sentencing. The once prosperous life he had enjoyed, basking in wealth, fame, and success, had abruptly disintegrated. His flourishing company had collapsed, and he was now bound for prison, facing a bleak future.

The Legal Battle and Its Consequences

When Charlie finally had his day in court, he chose to plead guilty to indirectly facilitating the transfer of an estimated one million dollars’ worth of Bitcoin to Silk Road. Fortunately, his sentencing was less severe than anticipated. The court sentenced him to two years in prison, though the prospect was still daunting for the 24-year-old entrepreneur.

Unfortunately, Charlie’s tribulations did not end there. Upon his release from prison in 2016, he found himself entangled in yet another legal battle. The Winklevoss twins filed a lawsuit, alleging that Charlie owed them 5,000 Bitcoin as part of a previous business agreement. By that time, the value of those Bitcoins had skyrocketed to approximately 32 million dollars..

The Birth of Gemini: A Safer Crypto Exchange

In the world of cryptocurrencies, Bitcoin has emerged as a revolutionary digital currency. Its journey has been marked by highs and lows, with significant events shaping its trajectory. One such event was the collapse of Mt. Gox, the main Bitcoin exchange, following a massive theft of 800,000 Bitcoins by hackers, just two weeks after Charlie’s arrest. This incident highlighted the need for a new wave of entrepreneurs and companies to ensure the safety of crypto transactions. Enter the Winklevoss twins, Cameron and Tyler, who recognized this demand and embarked on a mission to establish a secure and regulated crypto exchange.

With the demise of both BitInstant and Mt. Gox, the Winklevoss twins understood the urgency to bring stability and order to the Bitcoin community. They envisioned a safer environment for individuals to buy and sell cryptocurrencies. In pursuit of this goal, they founded their own crypto exchange, Gemini. Regarded as the world’s most regulated crypto exchange, Gemini aimed to instill trust and transparency among its users. This move by the Winklevii set the stage for other companies, such as Coinbase, FTX, and Binance, to follow suit and prioritize user safety. The twins’ unwavering commitment to mainstreaming Bitcoin paid off, evident in their remarkable decision never to sell a single Bitcoin. Owning approximately one percent of all Bitcoins, they became the world’s first known Bitcoin billionaires, thanks to the rise in Bitcoin’s value and the success of regulated exchanges.

Expanding Horizons: The Winklevoss Twins and Blockchain

While the Winklevoss twins attained incredible wealth through Bitcoin, they did not rest on their laurels. Their journey expanded into various blockchain-related ventures, showcasing their entrepreneurial spirit. One such project is Nifty Gateway, an innovative platform for trading NFTs (non-fungible tokens). Furthermore, the twins demonstrated a deep interest in Web3 and decentralization, advocating for web services and applications to be controlled by users rather than large corporations like Google and Facebook. This newfound focus on empowering users led some to speculate whether the twins were still driven by a desire for revenge against Mark Zuckerberg.

The Dual Perspective: Redemption or Opportunism?

Examining the Winklevoss twins’ story reveals contrasting viewpoints. On one hand, their journey can be seen as a tale of redemption. Following the Facebook lawsuit and the subsequent tarnishing of their image, the twins found themselves excluded from the social media boom. However, their keen insight into the potential of Bitcoin, combined with their resolute dedication, propelled them to become billionaires while contributing to the widespread adoption of cryptocurrencies. On the other hand, critics argue that their success is merely a result of early entry and fortunate timing, enabling them to profit from the rising value of Bitcoin. Additionally, skeptics question the legitimacy of their financial resources, as their initial investment in Bitcoin was made possible by the settlement they received from Facebook. This settlement, some argue, was undeserved since their idea differed from Facebook’s core concept. Ultimately, the truth likely lies somewhere in between, making the Winklevoss twins’ story an intriguing narrative of the early days of Bitcoin.

As we assess Bitcoin’s present state, it is evident that it has garnered significantly more popularity compared to previous years. Nonetheless, the price of Bitcoin remains highly volatile, leaving its long-term viability uncertain. The question of whether Bitcoin will truly prove useful in the long run remains unanswered. However, its impact on the financial landscape and the possibilities it presents for decentralized systems cannot be ignored.