In 2009, a man by the name of James Howells proved himself to be a visionary. He started mining Bitcoin before anyone else had ever heard of it. James managed to stockpile 7,500 bitcoins when they were just a fraction of a cent per coin. Eventually, his girlfriend made him stop because she thought that the computer doing the mining was getting too noisy. James later ended up throwing the hard drive in the trash, and today this mistake cost him over $400 million.

In 2010, Laszlo Hagnex bought two pizzas for 10,000 bitcoins, or about $35 at the time. It wasn’t the first transaction in Bitcoin, but certainly the most widely publicized. Unfortunately, today these delicious pizzas cost him half a billion dollars.

It’s stories like this that make Bitcoin such a fascinating phenomenon. Its growth and adoption, at least over recent years, has been mind-blowing. But the story of how Bitcoin came to be is just as interesting.

Despite Bitcoin’s young age when compared to traditional stores of value, the fundamental ideas behind crypto may be older than you think. So, the question has to be asked: Where did Bitcoin actually come from? Who is the mysterious individual who invented it?

Bitcoin: Beyond the Skepticism

For many, Bitcoin is still considered a fad, a Ponzi scheme, something that would disappear as quickly as it materialized. The cryptocurrency has been tainted by the existence of counterfeit crypto scams like Bitconnect and Onecoin, as well as its association with illicit activities such as drug purchases on Silk Road.

However, perceptions are shifting as more people begin to question the flaws inherent in our economic system. The constant creation of currency, rising food prices, and increasing bond yields all point to the specter of inflation. Moreover, history has shown that fiat currencies tend to lose value over time.

Friedrich Hayek, winner of the 1974 Nobel Prize in Economics, stated the following in 1984: “I don’t believe we shall ever have good money again before we take the thing out of the hands of government. All we can do is, by some sly roundabout way, introduce something that they can’t stop.”

While Bitcoin is far from flawless, it aligns closely with this vision. As we delve deeper, you’ll come to understand why it is an unstoppable force. But before we proceed, let’s provide a brief overview of Bitcoin.

Unlocking the Power of Decentralization

When you make a purchase at a store using a bank card, the store verifies with the bank whether you have sufficient funds. The bank cross-references its records, confirms the availability of funds, and deducts the corresponding amount from your card. In return, the bank charges a fee for facilitating the transaction.

If we were to eliminate banks from this equation, who could we rely on to maintain accurate and unalterable transaction records? Entrusting such power to a single individual would be unthinkable. However, the collective trust of millions of individuals becomes a viable solution.

The key concept is to eliminate centralized transaction records. Instead, multiple copies of these records are distributed worldwide. Each owner of a copy meticulously documents every transaction. Under this new model, the store no longer consults banks but rather cross-references everyone’s records to verify the availability of funds. Once the purchase is made, all record keepers update their respective records.

If a particular transaction record is fraudulent and does not align with the rest of the copies, it is promptly rejected. The responsible group scrutinizing these records is not comprised of human beings; rather, it consists of a network of interconnected computers. This decentralized network ensures the system’s integrity, rendering intermediaries like banks unnecessary.

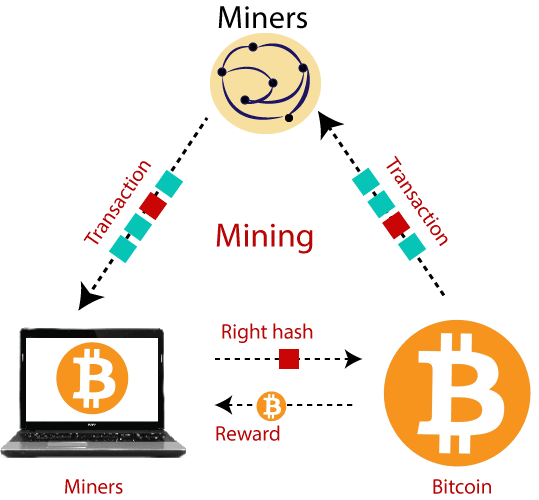

The Role of Miners and Unstoppable Transactions

In this decentralized model, the network is upheld by a group of individuals known as miners. These miners, operating powerful computers, solve complex mathematical equations to validate and record transactions. The transactions are grouped into blocks, analogous to pages in a record-keeping book. Miners are rewarded with Bitcoin for their efforts, akin to mining gold. Crucially, Bitcoin’s finite supply, with a maximum limit of 21 million coins, prevents devaluation and provides a safeguard against inflation—a pressing concern within the fiat currency landscape. The final Bitcoin will be mined in 2140.

One of the most remarkable features of Bitcoin is the unstoppable nature of its transactions. Unlike traditional payment systems that can be subject to bans, server shutdowns, or payment blockades, Bitcoin transactions occur directly between individuals. While transactions can be tracked, they cannot be halted or interfered with. This characteristic ensures the resilience and accessibility of the Bitcoin network, making it an attractive proposition for those seeking financial autonomy.

The Value Perception of Bitcoin

Intriguingly, the value of Bitcoin is not based on any tangible asset or government backing. Rather, its value derives from the simple principle of supply and demand. Bitcoin’s worth is determined by what individuals are willing to pay for it in the market. Consequently, if confidence in Bitcoin diminishes, there is a possibility that its price could plummet to zero. Nonetheless, this notion remains captivating and worthy of exploration.

Some argue that the true value of Bitcoin lies in the trust and utility it offers through the Bitcoin network. However, quantifying this value remains a challenge, as it is a novel and evolving concept. The exploration of Bitcoin’s intrinsic worth is an ongoing endeavor, with experts and enthusiasts continually analyzing its potential.

The Maintenance Process of Bitcoin

Now, let’s delve into the maintenance of Bitcoin. As an open-source cryptocurrency, anyone can modify its code. Contrary to the misconception that the code has remained stagnant for the past decade, there are continuous efforts to ensure its smooth operation. These endeavors are carried out through Bitcoin Improvement Proposals (BIPs), which are documents proposing core changes. However, in order to prevent unauthorized code insertions such as one that might distribute a thousand Bitcoin to every reader of this article, a consensus of 95% agreement among the last 2,000 miners is required. Essentially, it functions as a digital voting system.

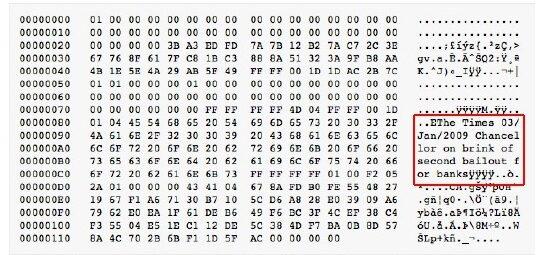

On January 3, 2009, the very first block of Bitcoin was mined. Interestingly, within this inaugural block, a special message was inscribed: “The Times 03/Jan/2009, Chancellor on the Brink of Second Bailout for Banks.” This message offers insight into the purpose behind Bitcoin’s existence—an alternative response to a flawed financial system. Merely nine days after the mining of the first block, the initial Bitcoin transaction took place. It involved Satoshi Nakamoto, the creator of Bitcoin, and another cryptography enthusiast named Hal Finney. At the time, the transaction consisted of 10 Bitcoin, which held no value as there were no exchanges to establish a price.

Bitcoin’s Origins

While the birth of Bitcoin can be traced to 2009, its roots extend further, reaching back to 1983. It was during this year that the groundwork for Bitcoin’s creation was laid. The subsequent years saw the progressive development of cryptographic techniques and the evolution of digital currency concepts. This context sets the stage for the eventual emergence of Bitcoin as a transformative force in the financial world.

In 1983, David Chaum embarked on his journey to revolutionize the concept of electronic cash. As part of the Cypherpunks movement, a group of passionate activists advocating for the use of cryptography to protect individuals’ privacy, Chaum explored innovative ideas that would pave the way for a safer and more anonymous transaction system. These digital libertarians believed in leveraging technology to empower individuals while preserving their right to privacy.

Chaum’s ingenuity led to the development of the blind signature protocol, a breakthrough in the realm of blockchain technology. This protocol enabled transactions that could prove specific attributes about an individual without disclosing their identity. For instance, someone could prove their age without revealing personal information or address. The blind signature concept laid the groundwork for a cryptographic electronic money system.

DigiCash: A Vision Realized

In pursuit of his vision, David Chaum established DigiCash in 1989. The company became a breeding ground for groundbreaking cryptographic innovations, attracting brilliant minds in the field. One such individual was Nick Szabo, a renowned cryptographer who would later leave his mark on the early crypto space.

In 1993, DigiCash introduced eCash, a revolutionary product that facilitated secure and anonymous money transfers over the internet. Chaum designed eCash as a response to the inherent risks associated with using credit cards for online transactions. Back then, online credit card payments were plagued by security concerns and excessive fees. With eCash, Chaum aimed to provide a technically impeccable solution that addressed these issues head-on.

Industry insiders marveled at the sophistication of the eCash system. It offered unparalleled security, ensuring that users’ financial details remained confidential while completing transactions. Moreover, it bypassed the need for intermediaries, eliminating transaction fees that burdened both consumers and merchants. DigiCash had succeeded in creating a revolutionary product that promised to transform the landscape of digital financ

Challenges and Controversies

Despite the undeniable merits of eCash, David Chaum’s vision faced significant challenges. The United States government perceived the groundbreaking technology as a threat, leading to secrecy orders placed on Chaum’s colleagues and friends. These orders made it a federal crime to disclose the nature of their research, hindering the progress of cryptographic advancements.

In a climate where the National Security Agency (NSA), the primary cryptographic authority in the United States, discouraged conferences and discussions on cryptography, Chaum’s unwavering belief in the importance of cryptographic freedom took center stage. He was willing to risk his own freedom, even if it meant spending his life in jail, to ensure that cryptography flourished without unnecessary restrictions.

The opposition faced by digital cryptography during those times compelled early enthusiasts to resort to unconventional means to propagate their ideas. Some resorted to smuggling code through intricate methods like embedding it in clothing or even getting tattoos. In many ways, the struggles faced by early proponents of cryptography foreshadowed the challenges that would later be encountered by cryptocurrencies like Bitcoin.

Bill Gates and the eCash Integration

The unprecedented attention garnered by eCash attracted the interest of none other than tech titan Bill Gates himself. Gates recognized the potential of Chaum’s creation and approached him with a proposal to integrate eCash into every copy of Windows 95. The ambitious project came with a staggering offer of $100 million.

Surprisingly, David Chaum declined Gates’ offer, as well as subsequent offers that followed. While the precise reasons for his refusal remain a matter of speculation, it highlights Chaum’s unwavering commitment to the principles and ideals he held dear. His focus extended beyond monetary gains, as he aimed to establish a digital payment system that prioritized privacy and security.

Digicash’s Downfall

According to ex-employees, David’s obstinacy and paranoia posed challenges for him in trusting the intentions of interested parties. Additionally, he held the belief that more enticing opportunities would arise in the near future. David possessed a strong desire for eCash to attain perfection, firmly believing in the significance of his work. Back in 1996, he expressed, “The fate of our society, whether it becomes a dictatorship or a true democracy, rests upon the disparity between a flawed electronic cash system and a well-crafted digital currency.” Unfortunately, due to internal conflicts, David eventually relinquished control of Digicash, and external investors gained ownership of the company.

Digicash embarked on efforts to promote their products to various banks, some of which displayed interest. However, during that period, the majority of banks maintained a conservative approach and preferred to adhere to lucrative credit cards rather than venturing into an experimental product. By 1998, Digicash had succumbed to bankruptcy, marking the end of the very first wave of digital currency.

The Early Concept of Cryptocurrency

The world may not have been ready for electronic crypto money initially, but forward-thinking individuals recognized its potential. While ahead of its time and lacking strong leadership, the idea itself remained promising. In 1999, renowned economist Milton Friedman emphasized the need for electronic cash to complement the burgeoning internet and serve as a tool for limiting government control. He envisioned a reliable e-cash system, enabling anonymous funds transfer between parties. Friedman also advocated for a computer-based monetary supply and policy to prevent human corruption. Despite such visionary ideas, the market faced challenges during the mid-1990s due to competing visions of centralized control. However, within this landscape, influential concepts emerged that paved the way for the eventual birth of Bitcoin.

During the mid-1990s, numerous companies emerged, capitalizing on the momentum generated by Digicash. In 1996, even the NSA published a paper titled “How to Make a Mint: The Cryptography of Anonymous Electronic Cash,” introducing their own cryptocurrency model. However, their proposal deviated from the decentralized philosophy, emphasizing the need for a centralized bank to monitor transactions. This contradicted the essence of the movement and hindered its progress.

Nevertheless, innovative ideas began circulating within online communities. Among them, Wei Dai, a University of Washington graduate, devised B-money in 1998. B-money aimed to establish online economies free from external regulations. Despite its popularity, B-money remained theoretical and failed to gain substantial traction.

Conversely, certain concepts lacked constructive intentions. Jim Bell’s assassination politics essay, for instance, advocated for an encrypted currency system that disgruntled citizens could employ to fund political assassinations. This idea eventually led to Bell serving time in prison.

The Significance of Bit Gold

Amidst the chaos, one idea stood out as a crucial precursor to Bitcoin: Bit Gold. Nick Szabo, a former Digicash employee, proposed Bit Gold in 1998. Unlike previous attempts, Bit Gold envisioned a digital currency that itself held intrinsic value, akin to a valuable commodity. Miners would be rewarded with Bit Gold for solving cryptographic equations. What set Bit Gold apart was its complete independence from traditional banking institutions.

Nick Szabo explains, “I was trying to mimic, as closely as possible, in cyberspace the security and trust characteristics of gold, and chief among those is that it doesn’t depend on a trusted central authority.” If David Chaum’s eCash was an early ancestor to Bitcoin, then Bit Gold was the missing link. Although it was an establishing building block for the future of cryptocurrencies, it was only theoretical and also flawed. For one, it had far less concern with privacy and also had some technical shortcomings when it came to mining. So, along with B Money, Bit Gold was never widely adopted.

The Birth of Bitcoin

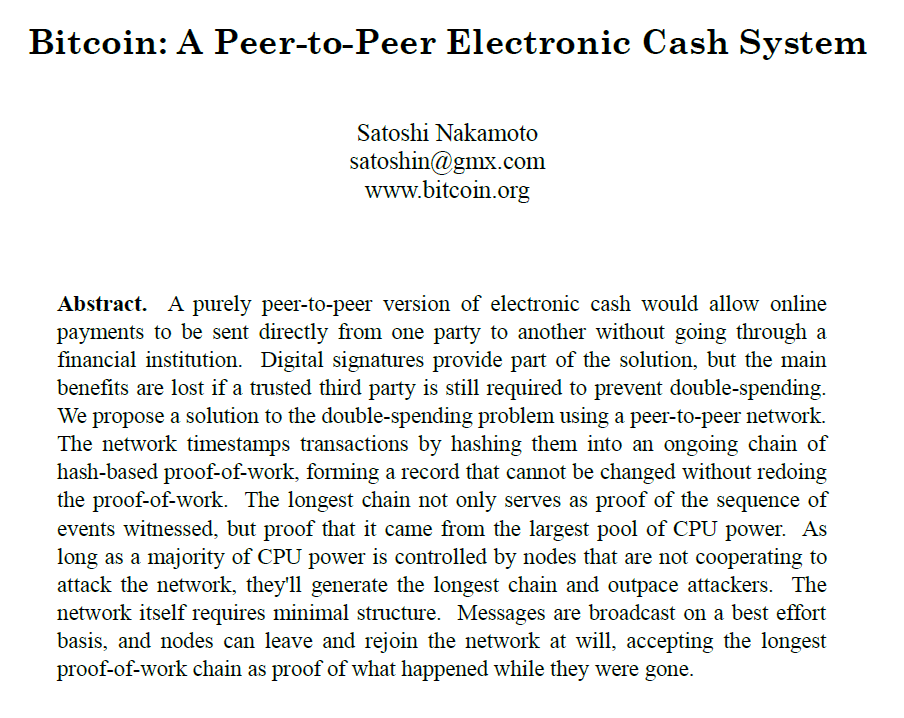

After a decade of remarkable advancements, the cryptocurrency community underwent a period of relative tranquility. However, in August 2008, an anonymous individual registered the domain name bitcoin.org, breathing new life into the scene. Shortly thereafter, in October, a groundbreaking document titled “Bitcoin: A Peer-to-Peer Electronic Cash System” emerged on a cryptography mailing list, bearing the signature of Satoshi Nakamoto. Within this publication, Nakamoto introduced the world to the fundamental blueprint of Bitcoin. This momentous paper sparked a cryptographic chain reaction that would ultimately reshape the course of financial history.

Fast forward to the present day, where nation states are eagerly exploring the creation of their own digital currencies. The city of Miami, for instance, envisions a future where its residents can settle their bills using Bitcoin. Meanwhile, established players such as PayPal, Mastercard, and Apple Pay have begun integrating Bitcoin into their platforms. Even industry giants like Tesla have made substantial investments, acquiring $1.5 billion worth of Bitcoin, and General Motors is actively considering adding Bitcoin to its balance sheet. It is evident that large financial institutions are now embracing the potential of Bitcoin and opening themselves up to its influence.

What truly set Bitcoin apart from its predecessors was its ingenious solution to the double-spending problem. Unlike physical stores of value, digital currency is essentially data, which can be replicated effortlessly. Consequently, this opens the door to the possibility of spending the same coin multiple times. Historically, this issue was resolved by relying on a trusted intermediary to oversee transactions—a role typically fulfilled by banks in the case of eCash. However, Nakamoto saw this as defeating the very purpose of Bitcoin. In a similar vein to Nick Szabo’s efforts with Bit Gold, the aim behind Bitcoin was to establish “a system for electronic transactions without relying on trust.”

Bitcoin’s Journey: From Inception to Trading

Bitcoin successfully overcame the challenge of double-spending by implementing an updated system that records ownership and transaction details. This groundbreaking solution gave birth to the blockchain technology. Once the double-spending problem was resolved, the system underwent online testing, proving its effectiveness. In 2009, Bitcoin became operational, and its journey began. By July 2010, it entered the market with a trading value of 0.0008 US dollars, which eventually rose to 0.08 dollars by the end of that month. However, at that time, Bitcoin didn’t attract much attention. Interestingly, the first Reddit post discussing Bitcoin in 2010 received downvotes. The TV series “Good Wife” featured Bitcoin for the first time in 2012, when its price was $3.41.

At $135, Chamath Palihapitiya expressed his perspective on Bitcoin, emphasizing its significance in allowing currencies to find stability, especially in emerging markets. He pointed out that during times of devaluation, financial instability, or political unrest in countries like Brazil, India, Argentina, Venezuela, Kenya, Russia, and China, the demand for Bitcoin would likely surge. Palihapitiya believed that these regions hold the key to the cryptocurrency’s success, rather than developments in more established economies like the United States, Japan, or the European Union.

Despite successfully creating a functional electronic cash system, Satoshi Nakamoto, the creator of Bitcoin, decided to maintain complete anonymity. On April 26, 2011, Nakamoto sent his last verified email and vanished from the public eye. Intriguingly, Nakamoto still possesses one million coins that have never been moved from his digital wallet. If the price of Bitcoin were to reach $197,000, Nakamoto would become the wealthiest person on the planet. This mysterious persona has fueled various speculations and false claims surrounding the true identity and motives of Satoshi Nakamoto.

4 Comments. Leave new

[…] the earlier article, it becomes apparent that Satoshi didn’t work alone. He collaborated closely with Hal Finney, […]

[…] Read More – Bitcoin Chronicles: The Mysterious Origins and It’s Global Influence […]

[…] of the Winklevoss twins with his passionate discourse on a groundbreaking technology known as Bitcoin. Surprisingly, the twins had not encountered Bitcoin before, which was not uncommon considering its […]

[…] delivered to sold-out venues worldwide, Dr. Ruja envisioned OneCoin as the ultimate successor to Bitcoin, promising an enhanced user experience and greater opportunities. The astonishing success of […]