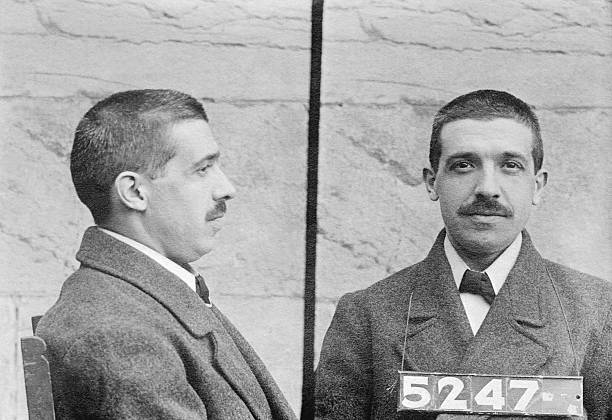

There was a time when Charles Ponzi, the mastermind behind one of the most successful investment schemes in America, was the talk of the financial world. He had access to millions of dollars and had people clamoring to invest with him, practically begging him to take their money. Little did everyone know the Ponzi’s business was built on nothing but lies. However, it was later revealed that Ponzi’s investment scheme was nothing but an outrageous scam, which made him a very rich man at the expense of ruining the lives of thousands of innocent people. The extent of Ponzi’s deception was so shocking and infamous that even a hundred years later, the scam still bears his name – the Ponzi scheme.

Early life in Italy and financial struggles

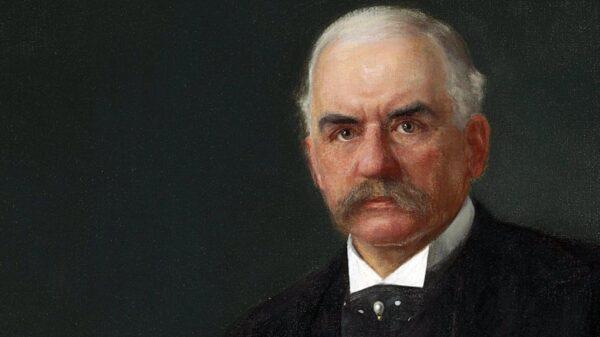

Charles Ponzi was born in Italy on March 3rd, 1882, to a hardworking postman father. Although his family was financially comfortable, Ponzi’s grandparents and great-grandparents had been successful businessmen, merchants, and public officials. The demotion to the working class had a profound impact on Ponzi from a young age, leaving him bitter and resentful. He couldn’t understand why he had to suffer for his family’s failing fortunes and why he couldn’t have been born rich, free from financial worries.

As a teenager, Ponzi inherited a modest sum of money following his father’s death. His mother hoped he would use it to enroll in a prestigious college to get an education. However, Ponzi had other plans. Instead of studying and going to class, he squandered his savings on the latest fashions and dining at the fanciest restaurants in town. He would then spend his evenings at the theater or opera, or gambling at the casino with his wealthy friends, indulging in all the extravagances money could buy.

Ponzi enjoyed pretending that he was just like his wealthy friends and had endless amounts of money, but it was all just an illusion. Eventually, his inheritance money ran out, and due to neglecting his studies, he had no chance of graduating from college. His uncle offered him work as a clerk, but the idea of a mundane 9-to-5 job repulsed Ponzi, who believed he was too good for menial labor. He felt that he had only one option left – to travel to America and strike it rich there.

A Struggling Immigrant in America

In 1903, the ambitious and determined Ponzi arrived in Boston aboard the SS Vancouver, carrying with him a burden of shame for letting his mother down. He believed that the only way to redeem himself was to return to Italy as a wealthy man. However, he faced a significant challenge—having no clue how to make that happen.

Ponzi’s life in America was a stark contrast to the privileged lifestyle he had enjoyed in Rome. Despite his disdain for physical labor, he was forced to take on various menial jobs in order to survive. Moving around the East Coast, Ponzi tried his hand at different professions, including sign painting, waiting tables, working in a grocery store, factory work, selling insurance, and repairing sewing machines. Unfortunately, he never stayed in any job for long. Whether it was due to his dissatisfaction with the work or his termination for attempting to cheat customers, Ponzi’s employment history was unstable. His desperation led him to resort to theft and begging for food, and he found himself sleeping in parks. It was a far cry from the extravagant and luxurious lifestyle he had once enjoyed. Whenever Ponzi managed to save up some money, he would quickly spend it on a lavish night out or a weekend vacation, attempting to relive his former high-rolling days.

A Risky Move to Montreal

In 1907, Ponzi decided to travel to Montreal in search of a more promising and lucrative opportunity. He hoped that Canada would be more welcoming and provide him with a fresh start. Initially, things seemed to look up for him. Ponzi secured a job as a clerk at Banco Zarossi, a bank primarily serving Italian immigrants. It was the same type of job he had rejected back in Rome, but a few years of struggling on the streets and working for minimum wage had humbled him.

Regrettably, Ponzi’s employment at Banco Zarossi turned out to be short-lived. Unbeknownst to him, his employer was a scam artist. The bank operated a long-standing swindle technique known as “robbing Peter to pay Paul.” This involved using the funds from recent clients to pay off previous ones, creating an illusion of financial stability. Zarossi enticed new clients with a 6% interest rate on all bank deposits, which was twice the prevailing rate. However, suspicions arose among the clients when their loved ones back home complained about not receiving the funds that the bank was supposed to send.

The Bank Scam that Changed Everything

In mid-1908, authorities began investigating Banco Zarossi for embezzlement. Fearing the consequences, Zarossi hastily filled a suitcase with all the cash he could carry and fled to Mexico, leaving his employees and their families to deal with the fallout from the scam. Ponzi, not wanting to be implicated in the investigation and the ensuing chaos, intended to travel back to the United States.

However, before making his departure, Ponzi made a grave mistake. In an attempt to avoid starting from scratch again, he decided to give himself a little “going away present” by forging a check from one of his bank’s clients, the Canadian Warehousing Company. Ponzi stole a blank check from the manager’s checkbook and filled it out for $423.58—a believable and unsuspicious amount, or so he thought. Unfortunately for Ponzi, his plan unraveled swiftly. The bank teller easily detected the fake signature on the fraudulent check and promptly alerted the police.

As a result of his forgery, Ponzi was sentenced to three years in St. Vincent de Paul Penitentiary. Little did he know that this was merely the beginning of his criminal career.

Rebuilding Life After Parole

After serving two years in prison, Ponzi’s release on parole marked a new chapter in his life. Eager to pursue his schemes once again, he embarked on a plan to smuggle five Italian immigrants into the United States. However, his hopes were dashed when he got caught and faced another arrest. Despite his anticipation of a lenient sentence, Ponzi was devastated to hear that he was to spend another two years behind bars in federal prison in Atlanta.

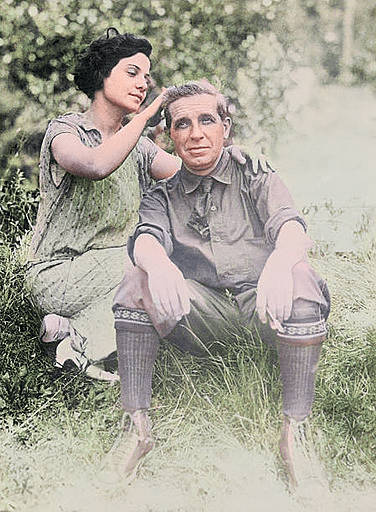

Following his second release, Ponzi found himself uncertain about his future. Despite having ambitious plans to amass wealth during his time in prison, he was now penniless. Consequently, he drifted from state to state, taking on odd jobs to make ends meet. Eventually, he secured a clerk position at the J.R. Poole Company, an import-export business in Boston. This turn of events led him back to where he had started his North American journey. Life in Boston proved more promising for Ponzi, as he excelled in his job and quickly received promotions. Additionally, he met Rose Gnecco, a 21-year-old woman whom he instantly fell in love with. They married in early 1918.

Failed Ventures and New Ideas

Although Ponzi found happiness in his married life, he yearned for a more extravagant lifestyle. His aspirations of showering his wife with luxury goods were far from attainable on his current income. Consequently, just six months after their wedding, Ponzi quit his job at J.R. Poole and set out to find a new venture.

Initially, he joined his father-in-law’s struggling wholesale fruit selling business, determined to prove his financial genius. However, despite his efforts, the business went bankrupt by the end of the year. Undeterred, Ponzi rented a small office space and attempted to establish his own import-export business. Unfortunately, his lack of experience hindered his progress, and he failed to attract substantial clients. Unfazed, Ponzi believed that increased advertising would solve his predicament. Yet, after assessing the costs involved, he realized the expenses were beyond his means. Consequently, his import-export business met the same fate as his previous venture.

The Ill-Fated Trader’s Guide

In his pursuit of advertising success, Ponzi conceived the idea of publishing his own trade magazine, the Trader’s Guide. Despite having no publishing experience, he envisioned the magazine as a lucrative endeavor. Ponzi intended to send it for free to a hundred thousand companies, increasing circulation with each new issue. He calculated that the initial mailing would cost him $35,000, but he anticipated earning $80,000 in advertising revenue, as he believed companies would eagerly advertise their services in his magazine.

Confident in his plan, Ponzi rented a larger office space and hired three staff members. He reached out to investors and business owners, promoting the potential of being involved in the first issue of the Trader’s Guide. However, reality soon shattered his dreams. The magazine failed to generate interest, and no one was willing to pay the exorbitant advertising rates he had envisioned. Desperate for funds, he approached a local bank for a loan but was swiftly rejected. Forced to make difficult decisions, Ponzi had to dismiss his staff and sublet his office space to generate income. Nevertheless, his determination to achieve wealth remained steadfast, and he clung to the hope that his next idea would bring him success.

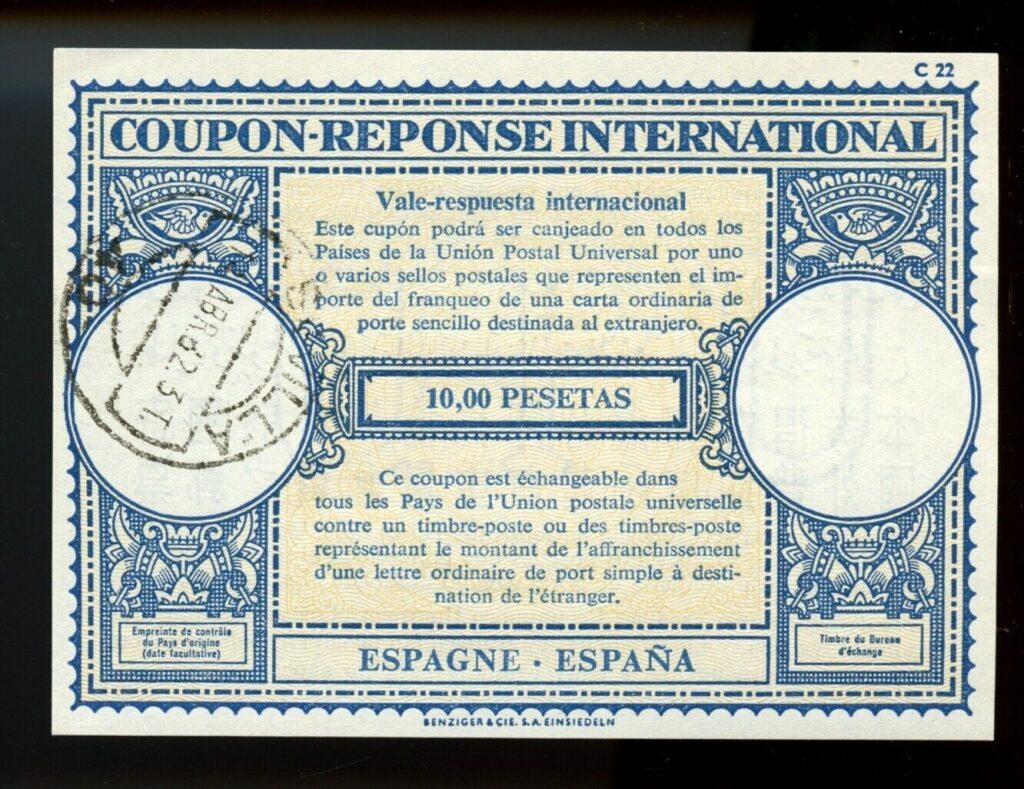

Amid Ponzi’s struggles, a letter arrived from Spain in August 1919, providing a glimmer of hope. In his pursuit of international business, Ponzi had contacted foreign companies, envisioning the Trader’s Guide expanding into various languages. The Spanish author of the letter expressed interest in receiving a copy of the magazine and included an international reply coupon (IRC) to cover postage. For Ponzi, the IRC became a source of inspiration that would change his life forever.

The Strategy of Arbitrage and its Allure

Years ago, Charles Ponzi stumbled upon the concept of arbitrage, which involves exploiting price differences in various markets to generate profits. Intrigued by the idea, Ponzi saw an opportunity to capitalize on the International Reply Coupons (IRCs), which could be purchased at different prices in different countries due to currency fluctuations. Although IRCs held the same postage value worldwide, Ponzi realized that he could buy them in a country with a weakened currency and redeem them for a higher value in the United States. By trading thousands or even millions of IRCs, Ponzi believed he could amass substantial wealth through this seemingly foolproof strategy.

In January 1920, fueled by unwavering optimism, Ponzi established the Securities Exchange Company to materialize his grand vision. He deemed this venture as his ticket to a life of opulence and success. Ponzi’s plan was straightforward: exploit the price differentials of IRCs to generate profits and sustain a thriving business. However, as reality set in, Ponzi encountered a harsh truth that threatened to shatter his dreams.

The Hurdles and Infeasibility of Ponzi’s Plan

Unfortunately for Ponzi, the profits generated through IRC arbitrage were minuscule when compared to the costs of shipping the coupons across borders. The scarcity of IRCs globally posed a significant obstacle to his ambitious operation. Yet, Ponzi remained resolute in his belief that this enterprise would lead him to immeasurable riches. Unwilling to abandon his vision, Ponzi transformed his unsustainable business idea into the notorious Ponzi scheme that bears his name.

At its core, the Ponzi scheme bears similarities to the age-old fraud known as “robbing Peter to pay Paul.” Ponzi had firsthand experience with this fraudulent practice during his time at Banco Zarossi. The scheme involves enticing individuals to invest their money by promising substantial returns within a short period and with minimal risk. However, instead of utilizing the funds for legitimate investments, the perpetrators keep the majority for themselves, distributing a portion to earlier investors to maintain the illusion of profitability. As these initial investors witness significant returns, they often reinvest their profits, further perpetuating the scheme. They also unwittingly become advocates for the fraudulent opportunity, mistakenly believing in its legitimacy. Yet, the reality is that the funds from new investors are merely used to compensate earlier participants.

The Inner Workings and Vulnerability of the Scheme

The Ponzi scheme capitalizes on individuals’ greed and financial naivety, relying on a continuous influx of new funds to sustain the scam. However, once the fraudster fails to secure enough new investors to pay the returns owed to earlier participants, the scheme inevitably collapses. Although Ponzi’s name became synonymous with this deceitful practice, he was not the

first to employ it. William Miller, a New York bookkeeper, successfully executed a similar scheme in 1899, defrauding investors of $1 million. Moreover, outside of the United States, a German actress named Adele Spitzer may have conducted the earliest recorded Ponzi scheme in the early 1870s. Nonetheless, Ponzi elevated this fraudulent tactic to unprecedented heights.

Promises of Prosperity and the Illusion of Legitimacy

Ponzi enticed investors by offering an astonishing 50% return in a mere 45 days, or a staggering 100% return within 90 days. These extravagant promises fueled dreams of unimaginable wealth, attracting individuals who sought quick and effortless riches.

When questioned about the mechanics of his operation, Ponzi skillfully evaded divulging details, citing concerns about aiding his competitors. His reluctance to share information created an air of mystery and exclusivity around his scheme, further enticing unsuspecting investors. Recognizing that his true talent lay in manipulating people rather than managing finances, Ponzi preyed on individuals with limited financial literacy. He sought out those who, like him, were driven by dreams rather than practicality, exploiting their vulnerability and desperate need for quick money.

Commencing with 18 investors from his local community, Ponzi swiftly gained momentum. As initial investors began reaping profits, word of mouth spread like wildfire, resulting in a frenzy of eager individuals crowding outside Ponzi’s office, desperate to partake in this seemingly foolproof opportunity.

Month after month, Ponzi amassed an ever-growing clientele, accumulating a staggering $250,000 per day during the pinnacle of his operation. The Boston Post, hailing him as a financial prodigy, further bolstered Ponzi’s perceived credibility, leading to an influx of new investors.

With newfound wealth, Ponzi indulged in a lavish lifestyle, residing in a grand mansion, driving fast cars, and adorning himself with opulent attire and jewelry. Yet, his reign of opulence was short-lived.

Doubts Arise: The Inquisitive Eyes of the Boston Post

As whispers of doubt circulated, the Boston Post embarked on an investigation into Ponzi’s operation. Clarence Barron, President of Dow Jones and manager of the Wall Street Journal, quickly uncovered the blatant scheme. Ponzi would have needed 160 million International Reply Coupons (IRCs), while only 27,000 existed worldwide.

Ponzi’s own downfall was sealed when he hired William McMasters as his publicist. An honest man, McMasters soon realized the extent of Ponzi’s fraud. Armed with incriminating evidence, he penned a Pulitzer Prize-winning exposé for the Boston Post, laying bare Ponzi’s deceptive secrets. The scheme’s inevitable collapse was imminent.

In the wake of Ponzi’s unraveling, multiple banks declared bankruptcy, leaving tens of thousands of people penniless, their life savings wiped out. The magnitude of the devastation caused by Ponzi’s scheme was immeasurable.

Despite the immense scale of his fraud, Ponzi managed to negotiate a deal and pleaded guilty to a single charge of mail fraud. The relatively lenient sentence of five years in federal prison seemed disproportionate to the magnitude of his crimes, leaving countless victims grappling with profound losses.

A Desperate Attempt at Redemption

Ponzi was released after three-and-a-half-years in prison. Immediately after his release from prison, Ponzi understood that he needed to evade deportation or further imprisonment. Seeking refuge in Florida, he founded the Charpon Land Syndicate, a company aimed at enticing investors to purchase property in Jacksonville. With promises of exorbitant returns, Ponzi claimed he could generate a 200% profit within just 60 days. Little did his potential victims know, the land he peddled was nothing more than worthless swampland. Unfortunately for Ponzi, this time around, there were no willing participants.

Ponzi’s fraudulent activities soon came to light, leaving him vulnerable to being extradited to Massachusetts, where a lengthy prison sentence awaited him. Desperate to avoid returning to his former life behind bars, Ponzi changed his appearance and attempted to flee to Italy disguised as a sailor on a cargo ship. However, his plan was foiled when he was apprehended in New Orleans, dashing his hopes for a successful escape. Left with no other option, Ponzi resorted to pen and paper in a desperate plea for clemency.

The Harsh Consequences

Facing the consequences of his actions, Ponzi found himself serving an additional seven years in prison. The man who emerged from his sentence was a mere shadow of his former self. Stripped of his charm and self-assurance, Ponzi was a broken man, haunted by the memories of his once lavish lifestyle. As he faced the prospect of deportation to Italy, his wife made the difficult decision to sever ties and remain in America, divorcing him in the process.

The remainder of Ponzi’s life was plagued by poverty, a stark contrast to the wealth he had once enjoyed. He eventually found himself in Rio de Janeiro, Brazil, where he breathed his last in 1949, destitute and abandoned. His final resting place was a pauper’s grave, marking the end of a notorious tale that encapsulated the journey from rags to riches, only to spiral back into destitution.

1 Comment. Leave new

[…] Read More – The Rise and Fall of Charles Ponzi: A Cautionary Tale for Investors Everywhere […]