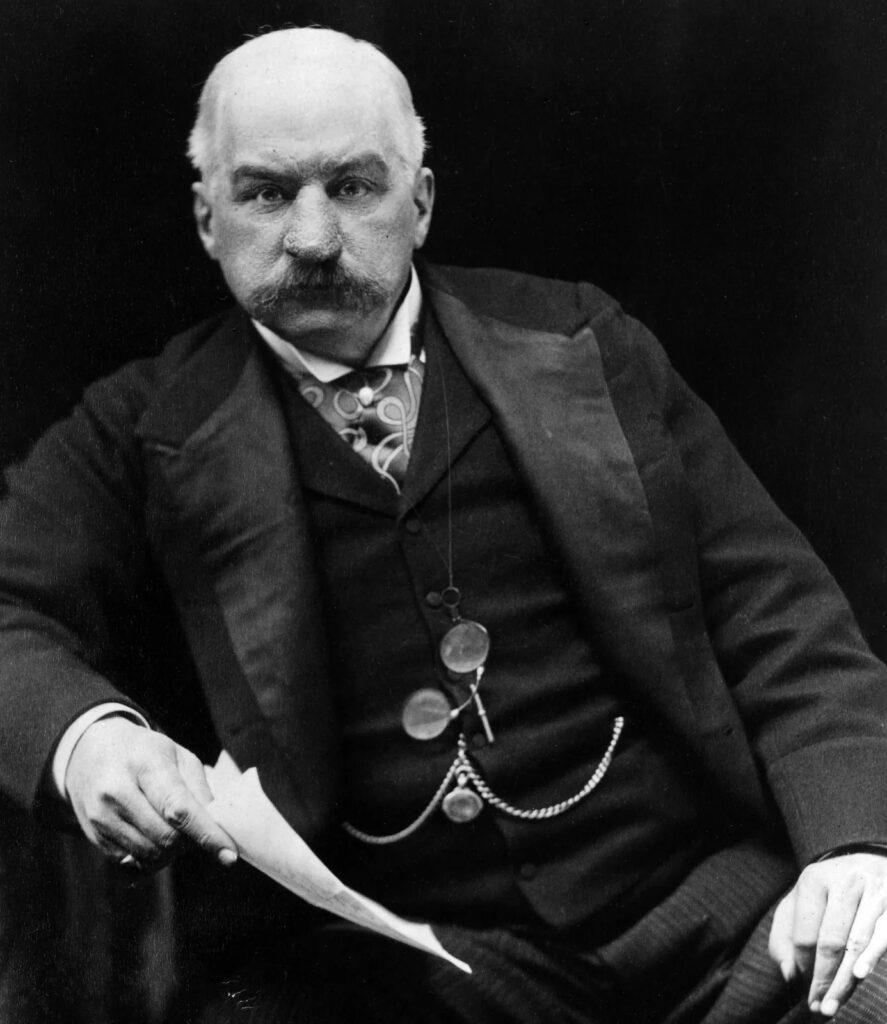

JP Morgan was a towering figure in American history, possessing enormous wealth, immense power, and unparalleled influence. He achieved the distinction of being the first person to own a billion-dollar company and dominated several lucrative industries in the country. In fact, on several occasions, the US economy hung on the actions of JP Morgan, demonstrating the extent of his power. A mere utterance or a stroke of his pen could save a company from financial ruin or lead it to inevitable bankruptcy. While some despised him, others looked up to him in awe. JP Morgan was a one-of-a-kind man, and his story is nothing short of extraordinary.

Early Privilege and Educational Opportunities

John Pierpont Morgan was born into a life of privilege, with his father, Junior Spencer Morgan, already established as a wealthy banker. Determined to provide his son with the best education money could buy, Junior Spencer Morgan ensured that John had every opportunity to excel academically. However, despite the wealth surrounding him, John’s childhood was far from idyllic.

From a young age, John suffered from a myriad of health issues, which cast a shadow over his early years. Frequent coughing fits, migraines, seizures, and ailments like scarlet fever restricted his ability to engage in typical childhood activities. Instead of joining other children outdoors, John found solace in studying and devouring financial statements. His illness became so severe that at one point, his father decided to send him alone to the Azores islands in the Atlantic Ocean, hoping the climate and salty air would aid his recovery.

Once John regained his health, he immersed himself in his education. By 1857, at the age of 19, he had already pursued studies in Boston, Switzerland, and Germany. His thirst for knowledge and exposure to different cultures laid a strong foundation for his future endeavors in the financial world.

John’s father, now a junior partner at London-based merchant banking firm George Peabody and Co., opened the doors to Wall Street for his ambitious son. Leveraging his father’s connections, John secured a position at a banking firm responsible for managing Peabody’s interests in America. It was here that John’s talent for writing reports on financial and political developments in the emerging American market came to the fore.

However, even from a young age, John’s father harbored concerns that his son’s impulsive nature and quick temper might hinder his ability to succeed as a financier. He believed that John needed to cultivate restraint and responsibility. An incident in 1859 exemplified this worry. While on a trip to New Orleans, John took what appeared to be a reckless gamble by utilizing company funds to purchase an entire shipment of Brazilian coffee that had arrived at the port without a buyer. Despite John’s successful sale of the coffee, yielding a substantial profit, the senior members of the banking house, including John’s father, disapproved of such risk-taking behavior.

The Birth of a Visionary

In 1861, at the age of 24, John took a daring leap of faith and founded his own company. While still acting as an agent for his father’s bank in England, he ventured out on his own, determined to prove his mettle in the financial world. This marked the beginning of a journey that would cement his place in history.

It was also that year that John married his first love, a frail young woman named Amelia Sturgis, and for a brief period, John was the happiest he’d ever been. However, Amelia soon came down with a persistent cough that was later diagnosed as tuberculosis. So right after their wedding, John took her on an extended honeymoon in the Mediterranean, hoping that the new climate might restore her strength, just like John’s father had tried for him when he was younger. But it was no use. John’s wife died just four months after their wedding, leaving John a widower at 24.

John’s London life took a tragic turn when he suffered the loss of his beloved wife at a tender age. This devastating event left him shattered, and it is believed that he never fully recovered. Seeking solace, he sought refuge in his work, throwing himself into it with even greater intensity.

As John dealt with his personal turmoil, the United States was grappling with the American Civil War. It was during this time that the 1863 conscription act came into effect, requiring individuals like John to join the fight. However, he took a different path. Instead of enlisting, he chose to pay $300 for a substitute to take his place.

Although John avoided direct involvement in the war, he found a way to capitalize on the conflict. One of his notable endeavors was financing the purchase of 5,000 surplus Hall carbine rifles from the government. These rifles were deemed too old for use and were sold for a mere $3.50 each. However, John and his consortium made slight adjustments to the rifles and quickly resold them to the government for an astounding $22 per rifle. This substantial increase marked a staggering 600% profit, making it an incredibly lucrative deal for John.

John’s war profiteering activities did not go unnoticed by the public or the government. While he undoubtedly benefited financially from these dealings, he faced widespread criticism and disapproval. The public viewed his actions as exploitative and unethical, tarnishing his reputation significantly.

The Birth of JP Morgan and Co.

In 1871, John seized a golden opportunity by partnering with Anthony Drexel, a prominent financier. Together, they established Drexel Morgan and Co., later renamed JP Morgan and Co., which would be John’s lifelong venture. This marked the beginnings of the banking titan we recognize today as JPMorgan Chase.

Unlike other industries controlled by single magnates like Carnegie in steel and Rockefeller in oil, the railroad sector presented a different landscape. Multiple competing companies vied for customers, often resorting to price wars. However, John perceived an opportunity where others saw fierce competition. He believed consolidation, rather than competition, held the key to success. Understanding the benefits of economies of scale, John aimed to merge smaller companies into one powerful conglomerate.

“Morganization”: John’s Path to Dominance

Recognizing the potential of consolidation, John strategically invested in various railroads and commenced the process of merging them. By acquiring underfinanced railroad companies, optimizing their management, and integrating them into a unified entity, he eliminated competition and gained control over nearby railroads. This masterful strategy, aptly named “morganization” after John himself, allowed him to dominate the industry and acquire any remaining competitors.

Diverging from his contemporaries, John went beyond being a passive investor. His desire for control led him to actively participate in the corporate management of the railroad companies. Utilizing his influential position on boards of directors, he orchestrated leadership reshuffles and consolidated multiple companies under his command. Only when granted full control would John lend his assistance, thus shaping a more stable industry and attracting increased investments.

John’s successes in the railroad sector attracted attention worldwide, leading to significant investments from Europe into the United States. The stability and profitability of the industry, thanks to John’s strategic approach, enticed European investors to channel their capital across the Atlantic.

Railway Industry Transformation

The railway industry underwent a profound transformation, with notable consolidation and stability brought about by the efforts of a key figure—John. His strategic acquisitions, ambitious mindset, and involvement in reorganizations and mergers propelled him to great success. This article explores John’s impact on the railway industry, from his influential acquisitions to his encounters with President Theodore Roosevelt.

John’s relentless pursuit of growth and consolidation led to significant changes in the railway industry. By acquiring more rail lines, he solidified his position and expanded his influence. For instance, he made a monumental purchase of 250,000 shares of stock from William Vanderbilt‘s New York Central Railroad, one of the country’s most prominent railways. This acquisition marked a turning point for John, catapulting him into a league of extraordinary railway entrepreneurs.

Driven by his insatiable ambition, John’s acquisitions knew no bounds. His relentless pursuit of success led him to execute the largest transaction in railroad bonds ever made in the United States. In this historic move, he underwrote the sale of 40 million dollars in bonds to finance the completion of the Northern Pacific railroad. With each acquisition, John’s power and wealth grew, as he became the owner of one-third of all roads in America.

The financing of the Northern Pacific railroad represented a pivotal moment in John’s career. By securing the sale of 40 million dollars in bonds, he demonstrated his ability to navigate complex financial transactions and ensure the completion of a critical railway project. This accomplishment further cemented his status as a formidable force in the industry, and his involvement in such a groundbreaking endeavor solidified his reputation.

During a time when railroad companies accounted for sixty percent of America’s stock market capitalization, John’s acquisitions and reorganizations played a vital role in shaping the industry’s landscape. His relentless pursuit of growth and consolidation resulted in the transformation of railway conglomerates. By actively engaging in reorganizations and mergers, he further propelled his power and wealth, leaving an indelible mark on America’s railroad history.

Beyond his financial achievements, John’s presence and commanding personality left a lasting impression. Despite his self-consciousness about his appearance, characterized by a skin condition called rosacea and the presence of rhinophyma,

he exuded power and authority. His towering height, combined with his assertive manner of speaking, made him an intimidating figure to be reckoned with. Photographs rarely captured the full extent of his distinctive features, as he often requested retouching to make his nose appear more normal.

John and President Theodore Roosevelt : The Encounters Between Two Strong-Willed Figures

In 1901, John encountered a formidable opponent who stood up to his influence: President Theodore Roosevelt. This clash of titans represented a turning point in John’s career, as he faced resistance from a leader known for his unwavering determination. The encounters between these two strong-willed figures would leave a significant impact on both the railway industry and the nation’s history.

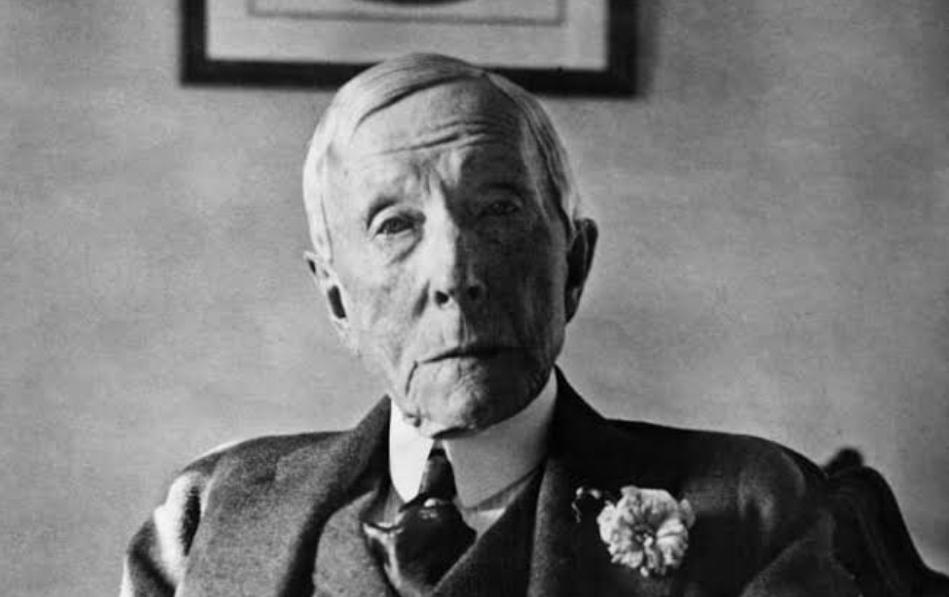

In a bold move, John D. Rockefeller successfully consolidated the Northern Pacific Railroad alongside two other regional railways. The birth of the Northern Securities Corporation created a massive new holding company, revolutionizing the railroad industry. This strategic move allowed Rockefeller to amass unprecedented control and influence over the transportation network.

Rockefeller’s close relationship with President William McKinley provided him with a shield against criticism for his monopolistic practices. However, the untimely assassination of McKinley changed the landscape entirely. With Theodore Roosevelt assuming the presidency, Rockefeller’s position of power faced an imminent threat.

President Theodore Roosevelt, known for his strong stance against monopolies, viewed Rockefeller’s actions through a different lens. Determined to uphold fair competition and protect consumers, Roosevelt instructed the Justice Department to initiate legal proceedings against the Northern Securities Corporation. The suit accused the company of violating the Sherman Antitrust Act of 1890, setting the stage for a historic legal battle.

As John D. Rockefeller fought the government’s allegations in court, the Northern Securities Corporation found itself facing its greatest challenge yet. Despite Rockefeller’s tenacity, the legal proceedings concluded with a ruling that mandated the dissolution of the company. This landmark decision served as a significant blow to Rockefeller’s empire and highlighted the growing power of antitrust legislation.

The clash between Rockefeller and Roosevelt went beyond the courtroom. John D. Rockefeller’s disdain for the new president was evident when he learned of Roosevelt’s planned trip to Africa. He infamously remarked, “Good, I hope the first lion meets him and does his duty.” This animosity further fueled the tension between the two men and set the stage for future conflicts.

Despite the setback caused by the dissolution of the Northern Securities Corporation, John D. Rockefeller remained undeterred. He continued to explore new ventures and embarked on a path that would cement his status as one of the most influential figures in American history.

Birth of U.S. Steel

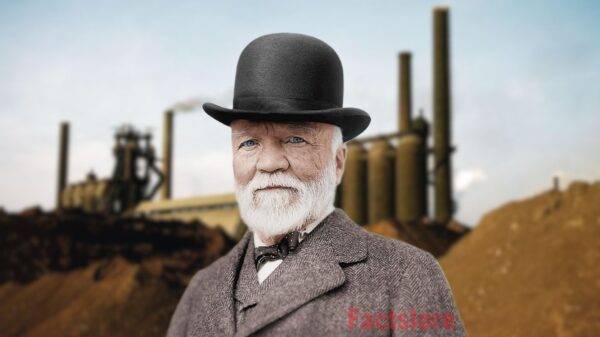

In 1901, the steel industry witnessed a historic turning point as Carnegie Steel, the dominant force in the market, came to the forefront. Andrew Carnegie, the visionary behind the company’s success, had amassed immense wealth, generating a staggering $40 million annually. However, with retirement on his mind, Carnegie sought to sell his company, posing the question of who could afford such a monumental acquisition. Enter John, the brilliant entrepreneur who had an offer Carnegie couldn’t refuse: a staggering $480 million, an unprecedented figure in business history. Remarkably, John admitted later that he would have willingly paid $100 million more. This landmark purchase marked the beginning of John’s audacious plan to reshape industries.

Having acquired Carnegie Steel, John embarked on a transformative journey. He orchestrated the merger of Carnegie Steel with the Federal Steel Company and several other enterprises, culminating in the formation of U.S Steel. This groundbreaking move established the world’s first billion-dollar corporation, boasting a remarkable market capitalization of $1.4 billion. To put this achievement in perspective, the combined capitalization of all manufacturing in the country at the time stood at a mere $9 billion. The merger granted John control over approximately two-thirds of the American steel production, effectively solidifying his dominance in the industry.

Expansion Beyond Steel: John’s Visionary Ventures

While conquering the steel industry alone would have been a remarkable feat, John’s ambition knew no bounds. He actively contributed to the advancement of various sectors, leaving an indelible mark on the course of history.

Recognizing the potential of electricity, John played a pivotal role in financing Thomas Edison’s early experiments. By providing essential resources and financial support, he helped propel Edison’s groundbreaking innovations. These investments laid the foundation for the modern era of electricity, revolutionizing countless aspects of human life.

Building upon his involvement with Edison, John orchestrated a significant merger, combining Edison Electric with its competitors to form General Electric (GE). This visionary move brought together leading forces in the electrical industry, fostering innovation and providing unparalleled solutions to power generation and distribution. General Electric emerged as a driving force in the rapidly evolving landscape of electrical technology.

John’s influence extended to the telecommunications realm, as he played a crucial role in the creation of what would eventually become AT&T. By leveraging his expertise and strategic acumen, he facilitated the consolidation of various telecommunication companies, shaping the future of the industry and establishing AT&T as a dominant player.

Despite his unrivaled talent for uniting companies and transforming them into formidable empires, John’s journey was not without its challenges. As his ventures expanded, unforeseen circumstances loomed on the horizon, ready to test his mettle and resilience.

The Economic Crisis of 1893 and John’s Audacious Scheme

In 1893, the United States found itself in the grips of an unprecedented economic depression. The burst of a longstanding bubble brought about a chaotic period, with stocks plummeting, businesses shuttering, banks going bankrupt, and unemployment rates soaring. Foreign investors, alarmed by the crisis, hastily exchanged their American bonds for gold, depleting the US reserves. As the dollar was then tied to the gold standard, this caused a loss of confidence in the value of paper money. The American government, relying on gold reserves to back the dollar, faced a severe shortage. With only nine million dollars’ worth of gold left, defaulting on loans loomed as a constant threat. The panic intensified as investors withdrew their funds, exacerbating the reserve depletion.

At this critical juncture, the absence of a central bank in the United States left the government in dire straits. President Cleveland recognized the gravity of the situation and understood that decisive action was required to prevent an economic catastrophe. Traditional methods such as selling more bonds to the American people were deemed insufficient. It was then that John, a visionary banker, embarked on a journey to Washington to present his audacious plan to the president, offering a way to salvage the country from the brink of collapse.

John proposed an ambitious strategy: the formation of a private syndicate comprising the most influential bankers in the nation, working in tandem with foreign investors to bolster America’s gold reserves. His syndicate pledged to purchase 65 million dollars’ worth of 30-year gold bonds, utilizing 3.5 million ounces of gold. Leveraging an old Civil War statute, President Cleveland could swiftly approve the deal without congressional deliberation. In a matter of minutes after Cleveland’s agreement, John instructed his associates in New York to take immediate action. Within just 22 minutes, they successfully acquired all the gold bonds.

John’s decisive actions exerted an instant calming effect on the turbulent financial market and restored faith in the economy. His remarkable intervention single-handedly averted a total collapse, saving the nation from further catastrophe. Furthermore, John’s astute business acumen allowed him to generate substantial profits by securing favorable rates on the purchased gold bonds.

While John emerged as the hero who rescued the nation and assisted the government in its hour of need, his influential role also sparked concerns. It shed light on the vast power and influence wielded by a single banker over the entire US economy. Doubts arose regarding John’s motivations: whether his actions were genuinely patriotic or merely driven by self-interest to enrich himself. In the subsequent election, the relationship between big banks and the government became a contentious topic for the Democrats. However, John and his fellow bankers generously donated to the Republican nominee, leading to their victory. Consequently, John maintained his close ties with the government. Nonetheless, this was not the only instance where John played a pivotal role in stabilizing the American economy.

John’s Continued Impact: The Crisis of 1907

In 1907, the country was facing another deepening financial crisis, which led to several banks being on the verge of bankruptcy, leading to hordes of people queuing up around the block to withdraw their money from their bank accounts. The government reportedly had to tell bank tellers to deliberately count the money slower to try and reduce the rate cash was being withdrawn because if everyone pulled their money out at the same time, it could be catastrophic.

By this point, Roosevelt was the president, and as we already know, he certainly did not see eye to eye with John on most things, but the crisis of 1907 was so dire that they both agreed it would be in America’s best interest if the government and big business worked together to save the country from falling into a depression. So Roosevelt called on JP Morgan to salvage the situation. Once again, John’s strategy was to spend a lot of money where it was needed most. He summoned dozens of the leading financiers and leaders of the nation’s biggest banks and trusts to join him in his private library on Madison Avenue and decide on the best course of action.

John’s plan was essentially for them to invest in their smaller competitors. John concluded that although some banks would inevitably fail, others could still be saved. So he and his associates deposited giant sums of money in a number of banks so that they would be able to pay their depositors and avoid declaring bankruptcy. After revealing his plan, John then locked the door while the bankers shaded among themselves, literally locking them in until they agreed on a resolution.

By the morning, everyone had agreed with John’s plan, and with Roosevelt’s approval, the U.S. treasury also contributed 25 million, showing the level of trust and respect the president had for John’s business sense. What’s remarkable is that John was 70 years old at this point and negotiated all of this whilst having a terrible cold, meaning he was constantly coughing and sneezing while saving the US economy. But his plan ultimately worked. Lots of capital was injected back into the economy, public confidence was restored in America’s banking system, and yet another economic disaster was averted thanks to John’s wheelings and dealings.

However, whilst he was once again briefly labeled as a hero, almost immediately, people began to realize just how dependent they had become on one single man. Something needed to change.

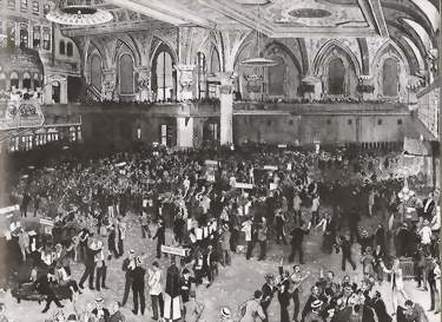

Public Concerns about Wall Street

John was facing increased scrutiny as the era of the unregulated robber baron was coming to an end. The American public was growing increasingly wary of a handful of businessmen wielding so much power and influence, and Wall Street’s money trust was under investigation. John was summoned to testify before the Pujo Committee, which aimed to uncover the true extent of the money trust’s reach and its impact on the American economy.

During the Pujo Committee hearings, John became the face of Wall Street power. However, despite his financial success, his mental state was deteriorating. He had multiple nervous breakdowns and struggled to cope with the negative portrayal of him in the media. Ironically, John was scheduled to board the Titanic for its maiden voyage, but health issues caused him to cancel at the last moment.

The Pujo Committee paved the way for the establishment of the Federal Reserve, recognizing that relying on a handful of ultra-rich and powerful individuals to fix the economy was not a sustainable solution. Unfortunately, John would never see the outcome of this investigation as he passed away a month later while on vacation in Rome.

Following John’s death, his son took over the business and continued its expansion. Despite numerous acquisitions and merges over the years, concerns remain about the bank’s overwhelming power. The bank has merged with Bank One, Bear Stearns, and notably, Chase Bank, to create JPMorgan Chase, which now boasts an estimated three trillion dollars in assets. After 200 years of consolidation in the banking industry, JPMorgan Chase is the world’s largest bank by market capitalization.

2 Comments. Leave new

[…] READ MORE- JP Morgan: The Hero Who Rescued America Twice […]

[…] Read More – JP Morgan: The Hero Who Rescued America Twice […]