In the realm of Silicon Valley, few startups have captured the world’s imagination quite like Theranos. Founded in 2003 by Elizabeth Holmes, a visionary in the eyes of many, the company set out on a mission that seemed nothing short of extraordinary. However, beneath the surface of its ambitious goals lay a web of deceit, manipulation, and ultimately, one of the most significant frauds in history. In this article, we delve into the rise and fall of Theranos, exploring its promises, the unraveling of its facade, and the lessons it imparts on the tech industry.

Theranos emerged onto the scene with a revolutionary concept—a blood analyzer capable of running hundreds of tests using just a small finger prick. The idea of conducting medical diagnostics conveniently at home garnered widespread excitement, attracting not only investors but also the attention of media outlets around the world. With its charismatic CEO, Elizabeth Holmes, at the helm, the company secured over six hundred million dollars in funding, raising its valuation to a staggering nine billion dollars.

The Rise of Elizabeth and Theranos

Elizabeth Holmes was born into a prestigious family with a remarkable lineage. From an early age, Elizabeth harbored a clear aspiration: to become a billionaire. At the age of 18, she embarked on a tour of China organized by Stanford, where she encountered a man named Sunny, who was 20 years her senior. Sunny, an immigrant from Pakistan, had experienced success during the dot-com boom of 1999, amassing a fortune of $40 million. He possessed what Elizabeth desired: wealth and the esteemed status of a prosperous entrepreneur. Sunny would later play a significant role in Elizabeth’s venture.

During one of her journeys to Asia, Elizabeth Holmes witnessed the devastating SARS outbreak. This pivotal moment served as a catalyst, propelling her towards a mission to transform the world. Determined to make a difference, she immersed herself in her room for five days upon her return, working tirelessly on an innovative patent idea. Her concept revolved around a wearable patch capable of continuously monitoring blood and administering precise doses of medication in real-time. Fueled by her unwavering determination, Elizabeth decided to drop out of Stanford at the tender age of 19, kickstarting her own venture. However, the early days were far from glamorous, with her company’s office situated in a neighborhood notorious for shootings.

One fateful day, while inside her car, Elizabeth narrowly escaped a gunshot fired in her direction. However, her perseverance paid off when she secured a significant 1 million dollar seed investment from a former neighbor who had experienced success through investments in Hotmail. Initially, Elizabeth relied heavily on the reputation of her investors. Yet, when it came to attracting investors with expertise in medicine, she struggled due to her limited knowledge and short time spent in university. Unlike tech entrepreneurs, who often succeed with minimal formal education, the medical and chemistry fields demanded extensive knowledge and years of research to achieve breakthroughs.

The Theranos Concept

By the end of the year, Elizabeth had successfully acquired nearly 6 million dollars in funding, leading to a significant evolution of her initial concept. The focus shifted to a cartridge and reader system for blood testing. Here’s how it was envisioned: patients would prick their fingers and collect blood in a small cartridge. Placing this cartridge into a compact machine would enable immediate testing. The resulting data would then be transmitted via the internet to a lab, where experts would interpret the results and provide a comprehensive report.

Traditionally, blood testing involved extracting a syringe full of blood from a vein and physically sending the sample to a lab, a process that took several days to yield results. Theranos aimed to revolutionize this procedure by condensing the components of large laboratory machines into a compact, personal computer-sized box. Their vision encompassed a faster, more convenient process that circumvented the need for doctor intervention.

However, beneath the surface lay the heart of the problem. Theranos faced insurmountable obstacles that rendered their machine nearly impossible. The close proximity of components led to interference from various factors, including heat, light, and electrical activity. Additionally, the blood samples, obtained from a mere finger prick, required dilution to achieve a sufficient volume for testing. Over-diluted samples resulted in inaccurate results, exceeding the detection capability of the hardware. In essence, for Theranos’ technology to succeed, breakthroughs on all fronts of blood analysis were required. All this while Elizabeth, lacking the necessary expertise, held the reins as the sole decision-maker.

The Birth of Theranos: Momentum and Deception

In 2006, Theranos gained traction, buoyed by its prototype, ‘Theranos 1.0’. Elizabeth Holmes, driven by ambition, sought to enhance the technology by commissioning engineers to create an improved version, known as the Edison. However, the truth was that no Theranos machine possessed the accuracy or capability to perform the wide range of tests claimed by Elizabeth.

Elizabeth, determined to push the limits of the Edison’s development, placed immense pressure on the engineering team manager to maintain a 24/7 work schedule. Despite the manager’s valid concerns about the engineers’ existing workload, Elizabeth resorted to a tactic reminiscent of Steve Jobs, pitting two engineering teams against each other in a survival-of-the-fittest race. However, in Theranos’ case, the stakes were higher, as the losing team faced termination.

Elizabeth’s questionable ethical practices extended beyond internal company dynamics. She conducted a pilot test in collaboration with pharmaceutical giant Pfizer, involving cancer patients. Despite being aware that the product was not yet functional, Elizabeth insisted on subjecting individuals with serious illnesses to real tests. This was particularly alarming considering that blood tests are crucial for adjusting medication dosages and diagnosing conditions requiring immediate attention. Doctors heavily rely on accurate lab results, with 70% of their decisions influenced by such findings. The potential repercussions of false results in this context could be catastrophic.

The cancer trials were only possible due to Elizabeth’s outright lies to both investors and clients regarding the effectiveness of Theranos’ product. In the same year, the company’s CFO discovered her deceit and confronted her. Instead of heeding his warning, Elizabeth reacted by immediately terminating his employment. Shockingly, she never filled the vacant chief financial officer position for the next decade, leaving an essential role unoccupied within the company’s hierarchy.

Elizabeth Holmes’ Manipulation and Betrayal

In 2007, Steve Jobs stood as an unrivaled star in Silicon Valley, commanding immense admiration. Elizabeth became obsessed on Jobs, to the point where she displayed a newspaper clipping on her desk, proclaiming her as the next Steve Jobs. This obsession bordered on madness. For instance, upon discovering that Steve held marketing meetings on Wednesdays, she replicated the practice by scheduling her own meetings with the same marketing firm. She even managed to recruit a few Apple employees, including Avie Tevanian, a long-time friend of Steve Jobs and the former Senior Vice President of Software at Apple. Avie was enticed out of retirement to join the Theranos board.

The board of Theranos comprised a prestigious panel of individuals. Don Lucas, who had mentored the founder of Oracle, served as the chairman. One day, Elizabeth proposed a restructuring of company shares, aiming to secure majority voting rights for herself. Avie, being a board member, opposed this idea, considering the information he had received from employees regarding testing problems.

Feeling compelled to take action, Avie discussed his concerns with Don Lucas, the chairman. However, his advice seemed to fall on deaf ears, leading Avie to resign. Elizabeth had an uncanny influence over the board; she was a master manipulator. To be taken more seriously, she consciously spoke in a deeper, more authoritative tone.

Shortly after the company relocated to a prime location in Silicon Valley, a startling discovery was made by a newly hired sales team member. It was revealed that the financial projections, on which the company’s success was predicated, were built upon deceitful pilot tests. The gravity of this revelation prompted an emergency board meeting, leading to the swift termination of Elizabeth, the individual responsible for the fraudulent projections. However, within a mere two hours of being informed about her dismissal, Elizabeth managed to reverse the board’s decision through her unparalleled persuasive abilities. This astonishing demonstration of persuasion played a pivotal role in the rapid ascent of Theranos, despite the absence of a functional technology. Shortly after the meeting, Elizabeth proceeded to dismiss those who had raised concerns, thereby continuing the trend of employees leaving or being let go. It is worth noting that within a couple of years, all the employees who had previously worked at Apple would also depart from the company.

The Revengeful Creation of a Patent

Around this time, an old family friend, Richard Fuisz, sought vengeance when he developed a groundbreaking patent for transmitting information from blood testing machines to doctors. His motivation stemmed from not being consulted when Elizabeth founded Theranos. With his expertise as a doctor, Richard had previously sold his medical demonstration video company for a remarkable $50 million. Little did anyone know that his patent, privately dubbed the “Theranos killer,” would play a crucial role in the downfall of the company.

Though Richard’s patents did not ultimately spell Theranos’ demise, his actions certainly had an impact. By 2009, Sunny, an affluent Pakistani immigrant, had become Elizabeth’s boyfriend and the company’s second-in-command. Although Sunny hailed from a software background, his understanding of the intricacies of a medical company remained limited. He claimed to have written an astonishing 10 million lines of code during his time at Microsoft, despite the average developer only producing around a thousand lines annually. Sunny’s proclamations about his vast wealth and his mere presence at work by choice further raised eyebrows. Furthermore, he exhibited a habit of latching onto buzzwords without truly comprehending the subjects. Engineers within Theranos even tested him by using technical terms out of context, yet Sunny continued to employ them. Nevertheless, he possessed a talent for manipulating people and instilling fear within the company. His volatile temper often resulted in abrupt terminations.

A Promising Partnership and Deceptive Claims

In 2010, Silicon Valley experienced an influx of capital as companies like Facebook, Twitter, and Uber gained momentum. Concurrently, Theranos engaged in discussions with major players like Walgreens and Safeway to establish partnerships and create wellness centers within their stores. These centers would offer patients access to blood tests. Theranos presented Walgreens with an impressive catalog of one hundred and ninety-two different tests that could be conducted using their Edison machine. However, only about half of these tests were theoretically viable. The sole evidence supporting the technology’s efficacy was a two-page review from Johns Hopkins Medical School, summarizing a meeting where Theranos showcased data results to university representatives. Alas, no direct testing was performed on the machines themselves. Nevertheless, Theranos had generated considerable buzz, and Walgreens was wary of missing out on such an opportunity, fearing that competitors might secure the partnership instead.

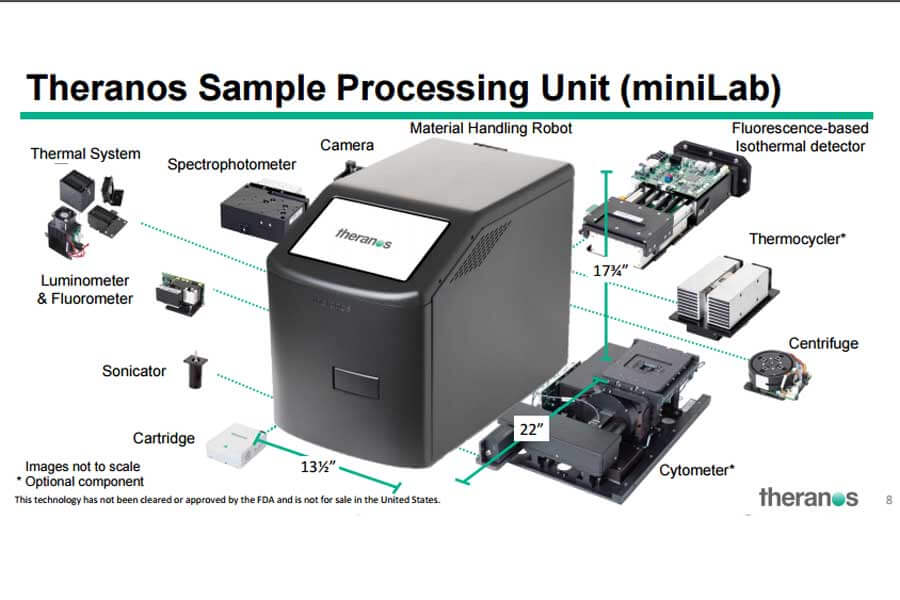

Elizabeth’s persuasive skills left a lasting impression on Walgreens and Safeway executives, resulting in their unwavering trust in her every word. Consequently, Safeway and Walgreens collectively invested a staggering one hundred and five million dollars in Theranos through investments and loans. Meanwhile, Elizabeth recognized the limitations of the Edison machine and commissioned the development of the third iteration, known as the mini lab, in her pursuit of a superior blood testing product.

Read More – Jho Low: The Real Life Wolf of Wall Street?

Fear Tactics and Ruthless Promotion

While the empire expanded, Sonny’s intimidating presence pervaded the company. He monitored employees via CCTV footage, meticulously tracking their work hours. On one occasion, he even threatened an employee after discovering that they had only worked eight hours in a day. Elizabeth supported this decision, asserting to the team, “If anyone here believes that you are not working on the best thing humans have ever built or if you’re cynical, then you should leave.” Promotions were generously bestowed upon those who echoed Elizabeth’s vision, while skepticism and doubt led to swift terminations.

By 2012, Safeway faced financial challenges after investing a considerable $350 million in renovations across their stores in preparation for the Theranos machines. Sadly, their expectations were met with perpetual launch delays and excuses. When Theranos eventually began accepting blood samples from Safeway employees, the samples were actually tested using existing commercial third-party machines in a separate lab. Deceptively, Safeway was led to believe that all tests were being conducted on Theranos’ Edison machines.

Theranos Lawsuit and Tragic Consequences

In the midst of Theranos facing a lawsuit from Richard, a medical doctor and envious family friend, the situation was intensifying. Richard was determined to bring down Theranos and had even hired a lawyer who previously handled Bill Gates’ deposition case, costing a whopping $1,000 per hour. This marked a critical moment in Theranos’s decline when Ian Gibbons, the leader of the chemistry team since 2005, received a subpoena. Theranos informed Ian that he would be involved in Richard’s trial in just two days’ time. Fearing that his words could jeopardize the company and expose its deception, Ian found himself in a state of misery. He had recently been demoted at Theranos and worried that, as a 67-year-old, finding another job would be nearly impossible.

The following morning, Ian’s wife, Rochelle, discovered him in the bathroom, having overdosed on medication. Sadly, he passed away a week later in the hospital. In a chilling display of callousness, Elizabeth, the head of Theranos, did not return Rochelle’s call regarding the death of her husband. Elizabeth only informed a select few employees about Ian’s passing and briefly mentioned the possibility of hosting a service, which was never carried out.

She appeared to have casually dismissed Ian’s death, showing little concern. Richard, after investing two million dollars in the case, suffered a significant blow to his pride. This incident would ignite Richard’s determination, ultimately leading to the downfall of Theranos. During this period, Theranos continued conducting tests using third-party machines, desperately striving for results. In a bid to increase testing capacity, they even stacked six mini labs on top of each other. However, this arrangement generated excess heat, further compromising the accuracy of the tests. Unfortunately, Theranos lacked the time to address this technological flaw. They had already made promises to the world and had a 140 million dollar contract with Walgreens, which required them to launch their product by February 2013. However, they were already four months behind schedule.

Fabricated Numbers and Political Connections

Theranos resorted to a series of lies and deceit to keep up appearances. Sunny, the charismatic leader, presented financial forecasts to investors that were ten times higher than the company’s internal projections. These numbers were completely fabricated, taking advantage of the absence of a Chief Financial Officer for the past seven years. Despite this alarming discrepancy, the influential and reputable names on Theranos’ board, including Henry Kissinger, George Shultz, and Jim “Mad Dog” Mattis, lent an aura of credibility to the company. Theranos had established strong political connections, even hosting a fundraiser for Hillary Clinton’s 2016 campaign. With massive investments pouring in from Partner Fund Management, Rupert Murdoch, the Walmart brothers, and the DeVos family, Theranos reached a staggering valuation of nine billion dollars, making Elizabeth Holmes herself worth five billion dollars.

While the flaws in Theranos’ technology were well-known within the company, employees were often too afraid to take action, fearing retaliation from Sunny, Elizabeth, or the company’s legal team. Confidentiality agreements further deterred individuals from speaking out, both during their employment and after leaving the company. However, Tyler Shultz, grandson of board member George Shultz, found himself in a relatively privileged position. Recognizing the inherent problems within Theranos, Tyler attempted to raise concerns with Sunny and Elizabeth, but his efforts fell on deaf ears. Frustrated, he decided to resign and turned to his grandfather for support. Tyler shared details about the inaccuracies of Edison, Theranos’ flagship device, and the consistent failures in quality control tests. He revealed how Theranos had compromised everyone’s well-being by conducting tests on third-party machines rather than their own Edison devices. Astonishingly, Elizabeth’s influence over George Shultz was so strong that he disregarded every word his concerned grandson uttered.

The fear instilled in Theranos employees through confidentiality agreements and the power wielded by Sunny and Elizabeth prevented many from taking action against the fraudulent practices. The company’s lawyers further reinforced this culture of intimidation, making it increasingly difficult for dissenting voices to be heard. However, Tyler Shultz’s decision to step forward as a whistleblower marked a turning point. Despite the personal risks involved, he bravely exposed the truth about Theranos, determined to reveal the company’s deceptive practices and protect the well-being of countless individuals.

The Celestial Ascendancy of Elizabeth Holmes

Elizabeth Holmes, the CEO of Theranos, became a prominent figure in the business world when Fortune magazine’s headline dubbed her “This CEO is out for blood” in mid-2014. Instantly, she attained celebrity status, appearing in various media outlets such as Forbes, USA Today, NPR, and more. With her groundbreaking claims and charismatic persona, she became the youngest self-made female billionaire, capturing the attention of the nation.

As Elizabeth basked in the limelight, her desire for security grew. She expanded her security team to 20 members and even revamped her office to resemble the President’s Oval Office, complete with wood paneling and bulletproof glass. Elizabeth’s fame reached its zenith when she delivered a TED talk, passionately discussing her vision to revolutionize healthcare. Her personal anecdote about her uncle’s battle with cancer tugged at the audience’s heartstrings. However, unbeknownst to them, her emotional story was a fabrication, a calculated move to manipulate public sentiment.

Cracks in the Empire

Underneath the veneer of success, Theranos faced mounting challenges. Richard, along with a group of skeptics, including Ian’s widow Rochelle, began gathering evidence of the company’s deceit. Armed with information, they approached John Kerry at The Wall Street Journal, who initiated an investigation. As the story unraveled, numerous anonymous sources and former employees stepped forward, providing damning information about Theranos. Fearing exposure, Theranos launched an aggressive campaign to silence those who spoke out, resorting to legal threats and hiring private investigators to intimidate their critics.

Desperate to halt the impending exposé, Theranos sent several letters to The Wall Street Journal, attempting to suppress the story through defamation threats. However, Rupert Murdoch, owner of The Wall Street Journal and an investor in Theranos, stood firm, choosing to prioritize journalistic integrity. Despite mounting pressure, the truth was set to be revealed.

Finally, on October 15th, 2015, The Wall Street Journal published a groundbreaking article that unveiled the dark truth about Theranos. The revelation sent shockwaves through the industry, prompting other major news outlets to pick up the story. People started to question Theranos and its culture of secrecy. Elizabeth, however, remained undeterred, brazenly lying to the public instead of addressing the mounting concerns. This time, though, the public was not willing to accept her words blindly; they demanded real answers.

The FDA’s surprise inspection of Theranos following the publication of a damning story revealed a shocking truth. The once-celebrated Edison blood testing machine, marketed as a breakthrough technology, had significant flaws. Out of the 250 tests it claimed to perform, it could only deliver accurate results for a mere 12 tests. The remaining tests produced wildly erratic and unreliable outcomes.

Theranos in Damage Control

With the extent of the deception exposed, Theranos found itself in full damage control mode. Elizabeth Holmes swiftly ended her relationship with Sunny Balwani and terminated his employment. The situation escalated further as criminal investigations and a probe by the Securities and Exchange Commission (SEC) commenced. Investors began filing lawsuits against Theranos, seeking significant compensation for their losses. Partner Fund sued for a hundred million dollars, while Walgreens sought a hundred and forty million.

In an effort to mitigate the fallout, Elizabeth had to settle a trial and pay four point five million dollars to Arizona State, where the majority of patients had received inaccurate testing. Furthermore, Theranos had to void nearly a million lab results. The company faced additional legal repercussions as ten patients filed lawsuits for medical battery. Despite this chaos, Elizabeth never offered an apology, viewing the situation as a mere stumble that could be rectified.

Elizabeth Holmes and Sunny Balwani were fully aware of their actions. They deceived investors, clients, regulators, patients, and even their own board. Their manipulation extended to granting Elizabeth an astounding ninety-nine point seven percent of the voting rights, skillfully misleading the experienced professionals on the board. Elizabeth demonstrated sociopathic tendencies, displaying a relentless drive for success, disregarding the consequences and the well-being of others. The extent of the lie and the possibility of its continued growth are astonishing. Even after the truth emerged, Elizabeth’s actions serve as a microcosm of a broader issue in society. It raises questions about the prioritization of success or the illusion of success above all else, and the human condition’s susceptibility to such manipulation.

Consequences and Legal Actions

The SEC reached a settlement with Elizabeth Holmes in March of 2018. As part of the settlement, she lost voting control, had to relinquish her stock, and received a ten-year ban from serving as an officer or director of any public company. Then in December 2022, Sunny Balwani, the former Theranos executive and ex-romantic partner of Elizabeth Holmes, got sentenced to nearly 13 years in prison over his role in the now-defunct blood testing firm. The sentence is slightly longer than that given to Holmes.

Balwani, who spent six years as Theranos’s chief operating officer, was convicted in July, 2022 on all 12 charges brought against him for defrauding Theranos investors and patients. His sentencing comes after co-conspirator Holmes received more than 11 years on 18 November, 2022 on four charges of defrauding investors. She was acquitted on patient-related charges.

The Fate of Theranos and Lingering Questions

Theranos met its demise in September 2018, leaving one question lingering: could they have succeeded if given the opportunity to continue? Would their blood testing machinery ever have delivered on its promises? The answer to these questions is more complex than it seems. In their desperate pursuit of funding, Theranos resorted to testing on real patients to showcase their concept, which ultimately exposed their deceit. However, even without testing on patients, the revealed mini lab fell short of expectations, despite having access to hundreds of millions of dollars. Considering these factors, it becomes highly unlikely that any company, including Theranos, could have succeeded in this endeavor.