In the world of cryptocurrency, one name has gained legendary status and sparked endless debates and curiosity – Satoshi Nakamoto. This enigmatic figure is credited with creating Bitcoin, the revolutionary digital currency that has taken the financial world by storm. Yet, despite Bitcoin’s widespread adoption and success, the true identity of Satoshi Nakamoto remains shrouded in mystery. In this article, we delve into the captivating story of Satoshi Nakamoto and the Bitcoin. But before we reach there we have to know the civil war within Bitcoin community and its present state.

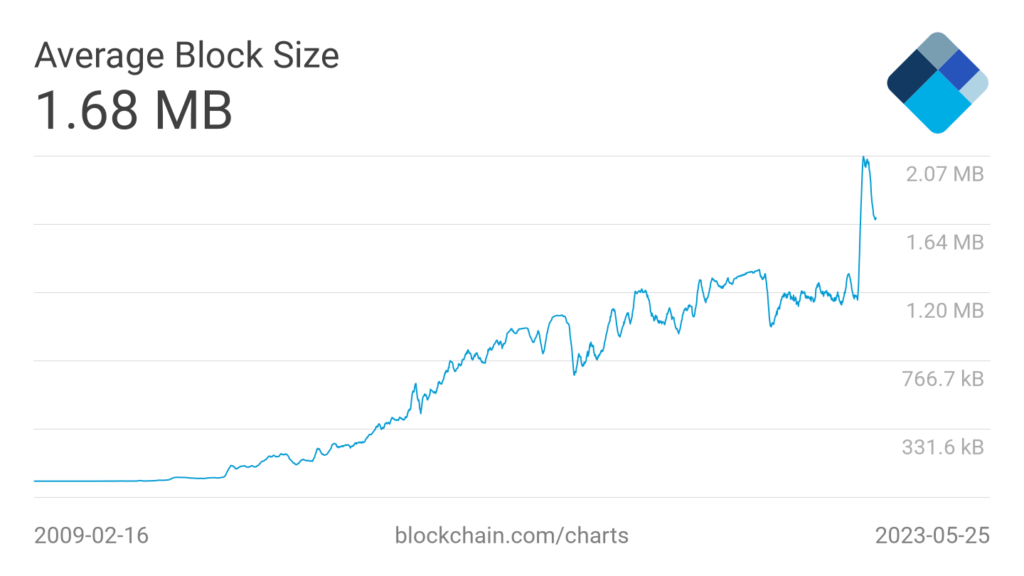

To fully comprehend the present state of Bitcoin, it is crucial to delve into the conflicts surrounding block sizes. Bitcoin mining involves the creation of blocks, which serve as records for the latest transactions. The size of these blocks, typically measured in megabytes, significantly impacts the functioning of Bitcoin.

In the early stages, Satoshi imposed a limit of one megabyte on the block size of Bitcoin. Why did he implement this restriction? Well, Satoshi was concerned that a miner within the network might generate an enormous block, reaching the scale of terabytes, thereby congesting the entire system. However, as time progressed, this limitation of one megabyte hindered Bitcoin’s scalability when faced with an increasing number of users. Consequently, as more individuals adopted the Bitcoin system, payment durations lengthened while transaction fees soared.

Even in the present day, Bitcoin can only handle approximately seven transactions per second. To provide some perspective, PayPal manages around 15 transactions per second, and Visa processes a staggering 2,000 transactions per second. Nonetheless, Satoshi foresaw this dilemma and expressed in his original writings that Bitcoin would undergo updates involving larger block sizes as it expanded. And this is where the predicament arises.

The Bitcoin Block Size Debate

In the world of Bitcoin, a significant divide emerged within the developer community, questioning the long-term viability of Bitcoin as a store of value versus its potential as a fast medium of exchange. This division resulted in contrasting viewpoints between the “big blockers” advocating for larger block sizes to accommodate more transactions and the “small blockers” who emphasized Bitcoin’s role as a store of value, prioritizing transaction speed and efficiency less. In this article, we delve into the Bitcoin block size debate, exploring the motivations, the players involved, and the subsequent consequences that unfolded.

The “big blockers” faction argued that increasing the block sizes would enable Bitcoin to function more effectively as a method of payment and electronic cash. Advocates believed that by facilitating a higher number of transactions, Bitcoin could rival traditional payment systems. They envisioned a future where the scalability issues could be resolved through larger block sizes, accommodating the growing demands of the network.

On the opposing side, the “small blockers” emphasized Bitcoin’s potential as a store of value. They regarded the original one megabyte limit as sufficient and were cautious about tampering with the existing structure. Their primary concern was the potential strain that larger blocks could place on network participants, fearing that it would favor large corporations with powerful computing resources, potentially leading to a monopoly-like scenario.

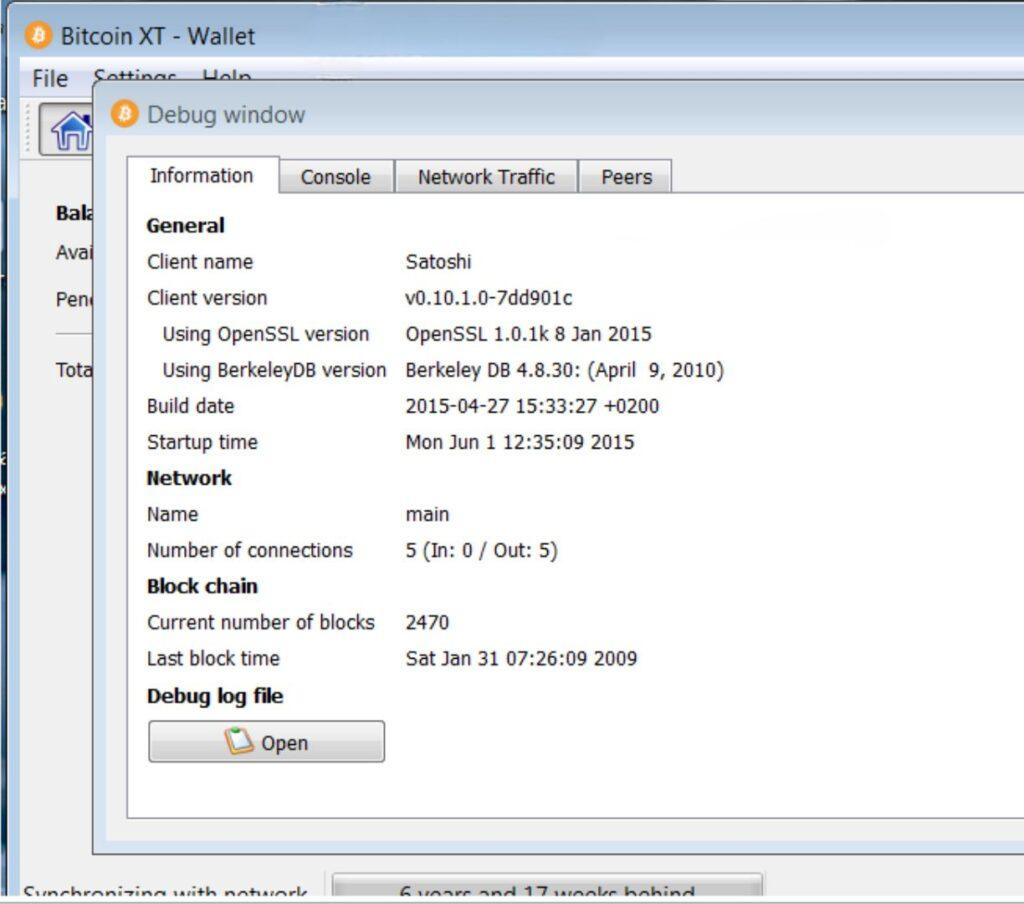

The Collaboration of Gavin Anderson and Mike Hearn: Bitcoin XT

In 2015, Gavin Anderson, the individual entrusted with Bitcoin’s development after Satoshi Nakamoto’s departure, joined forces with Mike Hearn, a Google developer, to address the block size dilemma. Their proposed solution was Bitcoin XT, a modified version of Bitcoin with a two megabyte block size. This implementation allowed for increased transaction throughput, reaching up to 24 transactions per second. The idea garnered considerable support, particularly from miners within the Bitcoin community.

Despite its initial promise, Bitcoin XT faced significant opposition from the “small blockers.” They perceived the move as a betrayal of the technical experts’ authority and a shift towards populism. Consequently, a series of strange events unfolded, leading to the diminished adoption of Bitcoin XT.

Unexpectedly, a wave of Denial-of-Service (DoS) attacks disrupted the Bitcoin network, specifically targeting Bitcoin XT nodes. These attacks flooded the network with excessive data, causing nodes to crash. Mike Hearn’s regional Internet Service Provider (ISP) even faced relentless DoS attacks for several days. Notably, only ISPs hosting Bitcoin XT nodes experienced these attacks. Furthermore, the official Bitcoin forum on Reddit took a peculiar stance, banning discussions related to Bitcoin XT.

Mike Hearn, in 2016, stated,

“Why has Bitcoin failed? It has failed because the community has failed. What was meant to be a new decentralized form of money that lacked systematically important institutions and ‘too big to fail’ has become something even worse: a system completely controlled by just a handful of people.”

Understanding the Bitcoin Community Split and its Impact

The Bitcoin community was experiencing evident disagreement, particularly among its developers, as they sought to address the scaling issue. In 2017, a solution called SegWit (segregated witness) was introduced and implemented. Its purpose was to optimize the storage of transaction data, allowing for more data to fit within a given block. Essentially, this involved removing the cryptographic signature from the block, retaining only the sender and receiver information.

The Birth of Bitcoin Cash: A Hard Fork Divides the Community

By implementing this process, additional space was created for data. However, in August 2017, some Bitcoin developers expressed dissatisfaction with the proposed SegWit approach. As a result, they initiated the development of a new Bitcoin version, effectively splitting it from the main chain through a process known as a hard fork. This led to the creation of Bitcoin Cash, which lacked the data-saving techniques of SegWit but featured an increased block size of 8 megabytes.

In Search of Original Purpose: Bitcoin SV Emerges

Over time, the Bitcoin Cash developers aimed to introduce further changes, triggering a disagreement. Craig Wright, an individual believed by some to be Satoshi (the anonymous creator of Bitcoin), opposed these changes, arguing that they deviated from Bitcoin’s original purpose. In 2018, Craig spearheaded a split from Bitcoin Cash, resulting in the formation of Bitcoin Satoshi Vision, also known as Bitcoin SV. Bitcoin SV eliminated the block size limit and boasted exceptionally low transaction fees.

The Bitcoin Satoshi Vision community holds the belief that Bitcoin SV represents the true Bitcoin. They argue that Bitcoin SV outperforms the mainstream Bitcoin in terms of technical superiority, enabling over 2,000 times the number of transactions per second. Despite its technical advantages, Bitcoin SV trades at a fraction of the price compared to mainstream Bitcoin.

On the flip side, concerns and controversies have engulfed Bitcoin SV. Notably, the entity CoinGeek currently possesses over 51% of the mining computing power for Bitcoin SV, raising suspicions of potential manipulation. Prominent figures like Vitalik, the creator of Ethereum, have denounced Bitcoin SV as a complete scam.

Today, due to internal conflicts and diverging viewpoints, the Bitcoin community remains divided into three distinct entities: mainstream Bitcoin, Bitcoin Cash, and Bitcoin Satoshi Vision. However, one cannot help but wonder if this fragmentation could have been avoided. Is there more at play behind the scenes?

The Intriguing Relationship Between Blockstream and Bitcoin

In 2014, amidst the ongoing scaling discussions, a company named Blockstream, specializing in sidechains, was established. Blockstream’s primary objective was to offer sidechains to enterprises, charging fixed monthly fees and retaining transaction fees. In essence, their aim was to alleviate strain on the Bitcoin network by conducting transactions off-chain while profiting from the fees instead of miners.

It is crucial to note that sidechains differ from blockchains. Sidechains are typically utilized to address limitations in the underlying protocol’s capabilities. Consequently, as Bitcoin improves, companies like Blockstream become increasingly obsolete.

It is important to note that Blockstream operates as a for-profit corporation rather than a foundation, which has raised eyebrows among Bitcoin enthusiasts. Compounding the intrigue is the speculation that Adam Back, the CEO of Blockstream, may also be the enigmatic Satoshi Nakamoto, the pseudonymous creator of Bitcoin.

A significant portion of the Bitcoin community expressed skepticism towards Blockstream. Many individuals have concerns about Blockstream’s Lightning Network, for instance. While it promises to enhance Bitcoin’s transactional speed beyond that of Visa, there are underlying costs to consider.

Deviation from the Original Bitcoin Ideals

At its core, the original Bitcoin system aimed to eliminate the need for intermediaries and trust in transactions. However, the emergence of Blockstream introduced a deviation from these foundational principles. The Lightning hubs, integral to the Lightning Network, now require financial regulation and extensive liquidity to maintain numerous well-funded open channels. Additionally, fraud departments must diligently monitor the blockchain to prevent theft, while transaction fees are imposed for each routed transaction.

Remarkably, the Lightning Network’s structure bears an uncanny resemblance to the traditional banking system. By replacing “open channel” with “checking account,” one can draw parallels between these Lightning Network hubs and the very financial institutions that Bitcoin sought to challenge. Curiously, the same banks that once resisted Bitcoin may now adopt its technology, essentially transforming Bitcoin into a banking system. The elimination of middlemen, fraud detection, permission requirements, and transaction reversals that characterized Bitcoin’s original vision have seemingly been compromised.

Deliberate Block Size Restrictions and the Influential Backers

Contrary to the notion that the limitations on Bitcoin’s block size are technical constraints, critics argue that the developers intentionally maintain the one-megabyte blocks. These artificially imposed restrictions give rise to exorbitant fees and lengthy waiting times, effectively creating demand for a solution—ultimately leading to the influence of the banking industry.

Compounding concerns, the entities funding Blockstream seem contradictory to the original vision of Bitcoin. Notably, AXA Insurance invested a substantial $55 million into Blockstream. At the time, AXA’s CEO, Henry de Castries, held the presidency of the Bilderberg Group—an organization known for its ties to global banking and corporate entities.

Furthermore, Blockstream received funding from the Digital Currency Group, whose prominent members boast affiliations with the Federal Reserve, World Bank, and Mastercard. This alignment with financial powerhouses raises questions about Blockstream’s grassroots credibility. CoinDesk, one of the largest news outlets in the cryptocurrency space, is also owned by individuals associated with Blockstream.

Adam Back has faced criticism for recruiting early Bitcoin developers into Blockstream to reshape the Bitcoin protocol. For many observers, it appears that Blockstream has hindered Bitcoin’s full potential through its group of developers, all while pursuing profit. Has Bitcoin been overtaken by banks through Blockstream? It may not be a definitive smoking gun, but the situation certainly raises numerous questions.

Unveiling the Mystery: Who is Satoshi Nakamoto, the Brilliant Mind Behind Bitcoin?

Satoshi Nakamoto, the enigmatic figure behind the revolutionary cryptocurrency Bitcoin, has skillfully concealed his true identity, leaving the world captivated by his anonymity. With an astute command of the English language and an unwavering commitment to privacy, Nakamoto’s meticulous actions have made it challenging to unmask him. Nonetheless, by examining the available evidence and tracing his linguistic idiosyncrasies, we can begin to unravel the mystery and shed light on the most plausible candidates for Satoshi Nakamoto’s true identity.

To begin with, we must establish two fundamental clues in relation to Nakamoto. Firstly, the original code for Bitcoin was written in the programming language C++. Secondly, Nakamoto exhibited two language peculiarities: a preference for British English over American English and a consistent utilization of double spaces after periods. These stylistic tendencies indicate that Nakamoto is an individual rather than a collective entity.

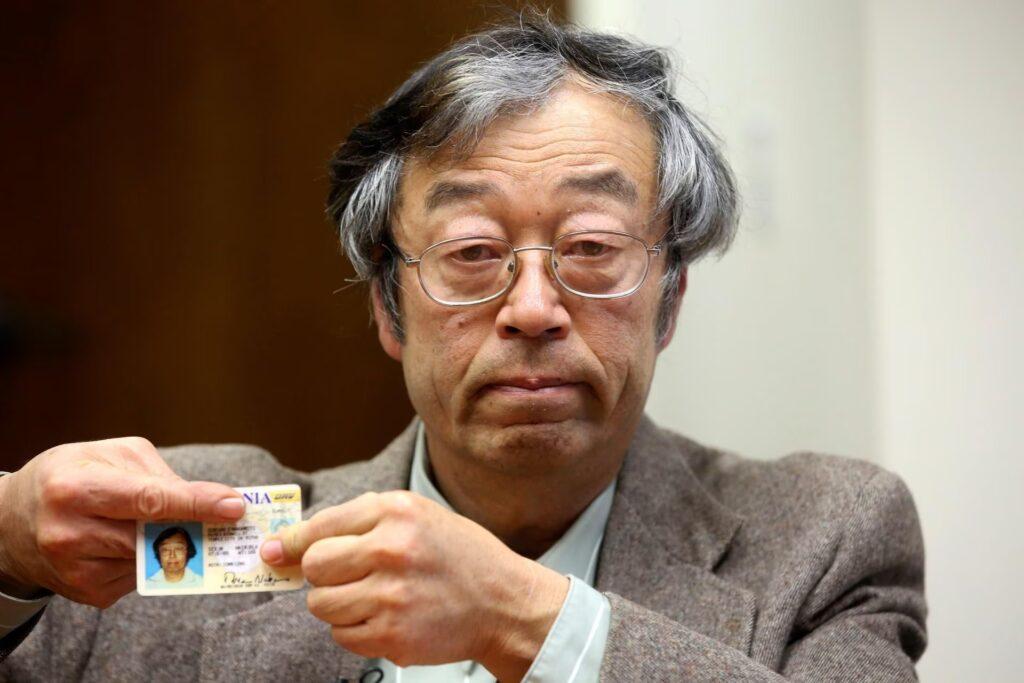

1. Dorian Nakamoto: A Tangential Connection

While not the most likely candidate, Dorian Nakamoto warrants a mention due to his connection to our subsequent candidate. Dorian Nakamoto, a Japanese-American physicist and engineer, inadvertently found himself under the spotlight in 2014 when a Newsweek article mistakenly identified him as the elusive Bitcoin founder. The sole basis for this claim was his shared surname, an example of what can be deemed as lazy journalism.

When confronted with the accusations, Dorian vehemently denied any involvement, stating, “I have nothing to do with Bitcoin. Nothing to do with developing.” It seems implausible that an individual so committed to cryptography and anonymity would brazenly use their legal name as an alias. The unwarranted media attention thrust upon Dorian posed unnecessary risks to his safety and privacy.

Fortunately, the supportive Bitcoin community rallied behind Dorian, generously donating 102 bitcoins, an act of solidarity that has now appreciated to a value close to 5 million dollars. This demonstration of support not only helped alleviate the unjust scrutiny he faced but also showcased the compassionate nature of the Bitcoin community.

2. The Enigmatic Relationship Between Satoshi and Hal Finney

From the earlier article, it becomes apparent that Satoshi didn’t work alone. He collaborated closely with Hal Finney, a cryptographer and a key figure in the cypherpunk movement. Before the world could witness the birth of Bitcoin, Satoshi dedicated a year and a half to coding in seclusion. He meticulously refined his creation, sharing his progress only with a select few individuals. One such individual was Hal Finney, who became an integral part of Satoshi’s inner circle.

In a twist of fate, it was Hal Finney who received the very first Bitcoin transaction. Curiously, Hal happened to reside in close proximity to Dorian Nakamoto. The possibility of chance encounters between them has led to speculations that Hal chose to adopt Nakamoto’s name as an alias in 2009, adding another layer of mystique to the narrative.

Unfortunately, Hal was diagnosed with ALS (Amyotrophic lateral sclerosis). Around the time Hal Finney was diagnosed with ALS, Satoshi’s frequency of posting in email forums began to decline. Some argue that this correlation suggests Hal’s involvement in testing Satoshi’s code. However, an alternative perspective questions why Hal would deliberately introduce bugs into his own code, only to solve them himself. In hindsight, this aspect adds intrigue to the story and hints at the possibility of intentional diversions

However, it’s important to remember that these were the early days of Bitcoin, when its future success was uncertain, and it could have easily faded away within a matter of weeks. From their perspective, such actions could be interpreted as a means of distancing oneself from being associated with the project.

Howard (Hal Finney) actively participated in various forums under his own name. Even on his deathbed, he consistently denied being Satoshi and admitted that he initially struggled to comprehend the intricacies of Bitcoin. Unfortunately, Hal Finney passed away in 2014 and made the decision to undergo cryogenic preservation, as he hoped to witness the future at some point. Considering that we are still discussing his legacy today, one could argue that he has, in a sense, achieved his goal.

3. Nick Szabo: A Pioneer in Cryptocurrency and Smart Contracts

The next candidate for can be Satoshi Nakamoto is an esteemed individual known as Nick Szabo, a name that resonates with the history and development of cryptocurrency. With a unique perspective on governments and their abuse of power, Szabo’s contributions to the world of digital currency are undeniable. In this article, we delve into the life and achievements of this remarkable individual, exploring his involvement in the cryptocurrency revolution and the concept of smart contracts.

Born in Hungary, Nick Szabo hails from a family deeply affected by the 1956 Hungarian Revolution. This background instilled in him a profound understanding of the potential dangers of unchecked governmental authority. With a computer science degree from the University of Washington and expertise in law and economics, Szabo possesses a diverse skill set that sets him apart in the world of cryptocurrency.

In cryptocurrency history, Nick Szabo has played a pivotal role at every stage. His groundbreaking creation, Bit Gold, brought him tantalizingly close to a major breakthrough. Additionally, Szabo lent his expertise to David Chaum‘s DigiCash, an early endeavor to introduce digital payments using cryptocurrency. These experiences solidified his knowledge and passion for cryptography-based money.

Szabo’s contributions extend beyond the realm of digital currency. In a seminal paper published in 1996, he introduced the concept of smart contracts, a revolutionary idea that would shape the future of blockchain technology. His forward-thinking vision laid the groundwork for the development of automated and self-executing contracts, enabling secure and efficient transactions in various industries.

The identity of Bitcoin’s elusive creator, Satoshi Nakamoto, has fascinated the cryptocurrency community for years. Some speculations have pointed towards Nick Szabo, igniting a debate that continues to captivate enthusiasts. One intriguing connection lies in an exchange where Satoshi mentioned his Bitcoin address having his initials. When exploring potential candidates, only the initials “N.S.” match among the possibilities. While it is possible that these initials refer to Satoshi Nakamoto reversed, Nick Szabo himself has consistently denied any claims of being Satoshi.

In the quest for Satoshi Nakamoto’s true identity, linguistic clues have been scrutinized for potential matches. However, Nick Szabo, with his Hungarian heritage, does not align with the British linguistic indicators often attributed to Satoshi. Moreover, Bitcoin’s code was predominantly written in C++, whereas Szabo’s coding experience, as testified by Wei Dai, the inventor of b-money, does not heavily involve C or C++.

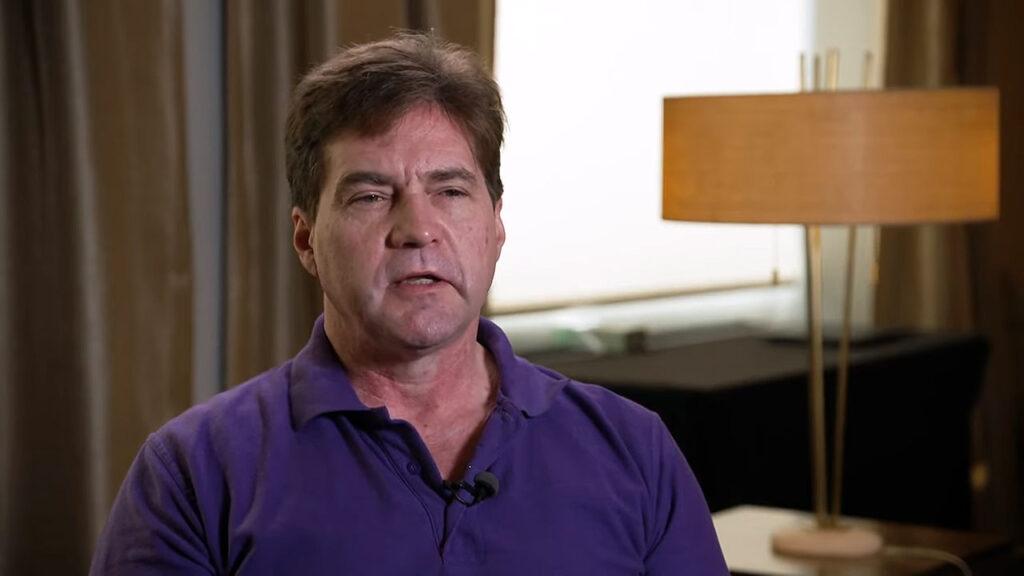

4. Craig Wright: Controversies, Accusations, and the Satoshi Mystery

Craig Wright, an accomplished Australian scientist with multiple degrees, has found himself at the center of controversy. In 2015, he was initially accused of being Nakamoto, the mysterious founder of Bitcoin.

What sets Wright apart from the other suspected founders is his unique journey. While initially denying the accusations, he eventually claimed them to be true. Greg Anderson, who had close ties to Satoshi, became convinced of Wright’s authenticity after witnessing Craig perform a digital signature on an address known to be owned by Satoshi.

One intriguing aspect that supports Wright’s claim is the linguistic connection between Australian and British English, which are largely interchangeable. Wired magazine has gathered a series of intriguing coincidences that reinforce their conclusion. For instance, posts on Wright’s blog coincided with and predicted the release of the original Bitcoin paper. Leaked correspondences between Wright and attorneys also suggested his involvement in running Bitcoin since 2009.

However, Wyatt and the crypto community were quick to point out inconsistencies in Craig’s story. The timeline became even more muddled when new evidence surfaced, indicating that Craig’s blog post may have been backdated.

Moreover, it seems unlikely that Nakamoto would remain anonymous for seven years only to claim credit when accused. In a significant setback for Craig’s case, in 2020 he provided a list of early Bitcoin addresses he claimed to own during an ongoing court battle. These addresses were momentarily and unintentionally made public. Surprisingly, an individual who indeed possessed these addresses used them to sign a public message debunking Craig’s ownership. The message boldly stated, “Craig Stephen Wright is a liar and a fraud. He doesn’t have the keys to sign this message.” This revelation dealt a severe blow to the theory that Craig was Satoshi.

Nevertheless, there are still fervent supporters within the Bitcoin SV community who firmly believe in Craig’s claim to being Satoshi.

5. Adam Back: A Prominent Figure in Digital Currency Research

Adam Back emerges as a strong contender for the enigmatic Satoshi Nakamoto, thanks in part to a 2020 documentary by the YouTube channel Barely Sociable. His significant contributions to digital currency research alongside pioneers like Wei Dai, David Chaum, and Hal Finney add weight to the possibility of him being Nakamoto. Furthermore, Back’s expertise in distributed computer systems, as evidenced by his PhD in the field, aligns perfectly with the skillset required to create Bitcoin.

In 1997, Adam Back invented Hashcash, a system that shares similarities with the proof-of-work mining algorithm utilized in Bitcoin. This connection establishes a strong link between Back and the foundational principles of Bitcoin. Additionally, both Nakamoto and Back exhibited a preference for British English and employed a unique double spacing style in their writings. A comparative analysis of Adam’s forum posts and Satoshi’s papers reveals striking similarities in their linguistic patterns. Notably, in a July 2010 post, Satoshi used the phrase “bloody hard to describe,” a distinctively British expression mirrored in Back’s communication style.

Further evidence supporting Adam Back as Satoshi Nakamoto lies in the absence of public messages exchanged between Nakamoto and Back. While there exist email correspondences between Nakamoto and various individuals involved in the early Bitcoin community, no such exchanges are available between Nakamoto and Back. Moreover, Back’s proficiency in C++, the programming language used to develop Bitcoin, further strengthens the case for his involvement.

During the first episode of Barely Sociable’s documentary, it was revealed that the inaugural block of Bitcoin included a headline from The Times newspaper. Given that Adam Back hails from London, the inclusion of a headline from a prominent British publication hints at a connection between him and the creation of Bitcoin. Additionally, Back was recognized for popularizing the trend of embedding political statements within code, a characteristic that aligns with the cryptic nature of Nakamoto’s work.

In a peculiar turn of events, when the wealth of Nakamoto was disclosed in a blog article in 2013, Adam Back promptly registered to join the Bitcoin forum on the very same day. This curious coincidence raises questions about Back’s eagerness to monitor and potentially control the narrative surrounding Nakamoto’s identity. Moreover, Back’s forum posts display a remarkable knowledge of obscure details pertaining to early Bitcoin bugs that were never publicly documented in change logs.

Conclusion

However, there is a factor that casts doubt on the belief that Satoshi is Adam. If Satoshi’s vision for Bitcoin entailed constantly increasing block sizes, why would Adam, through his association with Blockstream, actively strive to maintain small block sizes? Moreover, if Adam were Satoshi, he would likely be one of the wealthiest individuals in the world, so why would he pursue any financial gain at all? Perhaps there is something we are overlooking here. One possibility is that Adam had a close working relationship with Satoshi but, for some reason, eventually aligned himself with the major banks.

So, the question remains: Who is Satoshi?

In truth, uncovering the true identity of Satoshi Nakamoto is not crucial to the success of Bitcoin. It is possible that Satoshi is one of the candidates previously mentioned or simply an entirely unknown individual to this day.

In ‘Bitcoin Chronicles: The Mysterious Origins and It’s Global Influence‘ article, we explored how visionary individuals in the ’80s and ’90s embraced the potential of digital cryptography. Their relentless efforts paved the way for the birth of Bitcoin. However, this intricate tale reveals that the genesis of Bitcoin is far from simple. It is entirely plausible that another cryptocurrency may emerge in the future and seize the global spotlight. Yet, regardless of what lies ahead, Bitcoin will forever be revered as the pioneering force that revolutionized the world of digital currency.