How does whatsapp make money? What started out as a very simple business question led anyone down a rabbit hole much darker than one would have imagined, that affects every single one of us. But to make sense of all this, we need to travel back in time.

The birth of Whatsapp

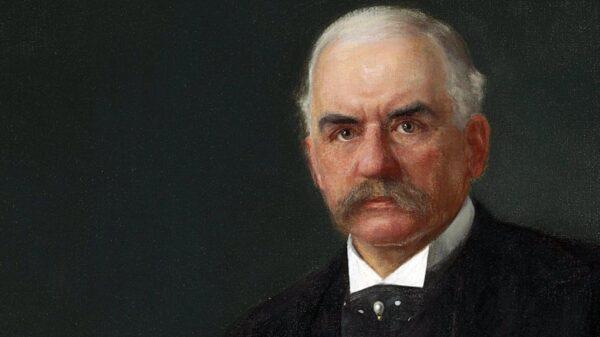

In the year 2009, a significant shift was occurring in the tech landscape with the introduction of the iPhone a few years prior. People were beginning to familiarize themselves with the innovative concept of smartphone applications. During this period, Facebook was experiencing rapid growth and a determined individual named Brian Acton sought employment there. However, his application was not successful. Undeterred, Acton eagerly awaited his next venture, which would emerge merely a few months later in collaboration with his friend Jan Koum.

Their brainchild was none other than WhatsApp—a groundbreaking smartphone application. Initially, WhatsApp was conceived as a platform for users to update their statuses. However, the game-changing moment arrived when private messaging functionality was introduced. This addition led to an exponential surge in the app’s popularity. The reason behind this rapid ascent was the prevailing costliness of traditional text messaging at the time. In contrast, WhatsApp offered a global instant messaging service completely free of charge.

The Founders’ Stance on Ads

In the highly competitive world of mobile applications, revenue generation is often a top priority for developers. While many apps rely on advertising, in-app purchases, or selling user data to monetize their platforms, WhatsApp, the popular messaging app, took a different approach. Founded by individuals who loathed intrusive advertisements, WhatsApp sought to create a remarkable product without compromising user experience. In this article, we delve into the story of WhatsApp’s revenue model and explore how it diverged from the conventional path.

The founders of WhatsApp were driven by a strong distaste for intrusive advertisements. Their deep-rooted convictions against bombarding users with ads led them to depart from their previous positions at Yahoo. They even expressed their disdain for ads in a blog post on the official WhatsApp blog. Rejecting ads as an option, they embarked on a mission to build a superior product that people genuinely desired. Their unwavering commitment to improving the user experience rendered advertising a non-viable choice.

Charging users for accessing app features was another revenue-generating option WhatsApp consciously avoided. The primary motive behind the app’s inception was to create a product that appealed to the masses, and imposing fees would undermine its widespread adoption. The founders’ unwavering focus on product excellence made user fees an unattractive alternative.

Both WhatsApp founders were staunch privacy advocates, and for a considerable period, they sustained the app without generating any revenue. They relied on the initial seed funding provided by affluent acquaintances from Yahoo while diligently keeping costs to a bare minimum. In their quest to save money, the WhatsApp team resorted to working on inexpensive IKEA tables and using blankets for warmth. In stark contrast to the typical Silicon Valley startup seeking rapid growth and enormous profits, WhatsApp stood as an exception.

Monetizing to Support Expansion

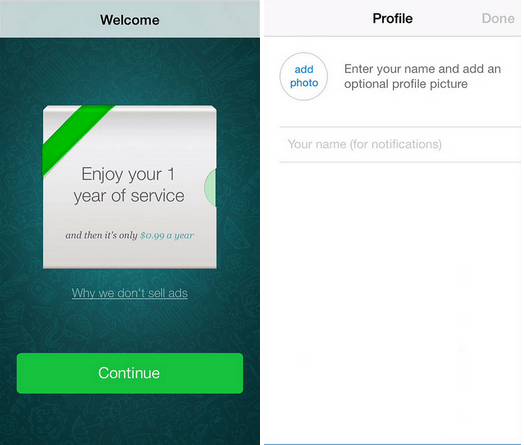

As the app gained immense popularity and new features, such as picture messages, were introduced, WhatsApp inevitably needed financial resources to invest in servers and expand its team. To address these needs, WhatsApp introduced a nominal $1 fee. Depending on the country, some users were required to purchase the app upfront, while others enjoyed a free one-year trial period before being charged $1 annually thereafter. Interestingly, the enforcement of this fee was relatively lax. WhatsApp often allowed users to retain the app even if they didn’t pay the renewal fee. This approach transformed the fee into more of a voluntary donation, which surprisingly proved successful. By striking a delicate balance, WhatsApp managed to avoid alienating its user base while still generating sufficient revenue to sustain its operations.

Although the $1 fee served as a valuable revenue stream for WhatsApp, its primary purpose was to cover operational expenses rather than yield significant profits. Despite the modest nature of this fee, its financial impact was relatively inconsequential. However, this seemingly unprofitable approach did not hinder WhatsApp’s growth or discourage its founders. Instead, they remained steadfast in their commitment to providing users with a convenient and ad-free messaging platform.

WhatsApp’s Reluctance towards Investor Influence

At the onset, WhatsApp’s founders exhibited a cautious approach towards accepting new investors. Their apprehension stemmed from the fear that investor demands might prioritize heavy monetization, potentially compromising the app’s quality. However, as WhatsApp’s user base expanded rapidly, prominent investment firms like Sequoia Capital recognized its potential and offered multimillion-dollar investments on WhatsApp’s own terms. This agreement allowed WhatsApp to retain its independence and forgo intrusive advertisements, while infusing a substantial cash injection. Thus, WhatsApp adopted a revenue strategy focused on securing investments rather than extracting additional funds from its users.

WhatsApp thrived by capitalizing on the network effect, a phenomenon wherein the value of a platform increases with each new user. By refraining from inundating the app with ads or excessive paid features, WhatsApp fostered accelerated growth. The absence of financial barriers facilitated widespread adoption as satisfied users eagerly recommended the app to their friends and family. This virtuous cycle led to a continuous rise in user count, attracting more investors and securing additional funds. WhatsApp’s strategic focus on creating the best user experience proved instrumental in harnessing the power of the network effect.

While WhatsApp’s reliance on investors fueled its initial growth, a crucial question loomed: could this approach be sustained indefinitely? Investors, at some point, would expect to witness a profitable business model. However, there existed an alternative path – a substantial acquisition that would offer a significant payout to the company. Such a scenario would bypass the necessity of developing a self-sustaining revenue stream. This lucrative exit strategy provided an intriguing possibility, albeit one that required careful consideration.

The acquisition of Whatsapp

In 2014, Facebook made headlines when it acquired the popular mobile messaging service, WhatsApp, for a staggering $19 billion in a cash and stock deal. The price tag raised eyebrows and left many people puzzled. It was revealed that in the nine months prior to the acquisition, WhatsApp had generated only $1.2 million in revenue and was operating at a significant loss. The question on everyone’s mind was: Why would Facebook pay such a hefty sum for a messaging app that seemed to have limited financial potential?

Mark Zuckerberg, the CEO of Facebook, shed light on the strategic rationale behind the acquisition. He emphasized the immense value of bringing Facebook and WhatsApp together, asserting that the synergistic potential was worth far more than the $19 billion price tag. Despite WhatsApp’s modest revenue compared to the acquisition cost, Zuckerberg acknowledged the scarcity of services with a global reach of over one billion users. Such services, he argued, held immense value in their ability to connect people on a massive scale.

Concerns and Controversies

However, Zuckerberg’s vision and the supposed synergy between Facebook and WhatsApp raised concerns for many. Facebook’s core business model revolves around collecting user data and leveraging it to deliver highly personalized advertisements. This stands in contrast to WhatsApp’s original stance, which aimed to protect user privacy. Furthermore, Facebook’s checkered history of privacy breaches, exemplified by the Cambridge Analytica scandal, where millions of users’ data was misused without consent, further fueled skepticism.

To allay concerns, Zuckerberg assured the founders of WhatsApp that the messaging service would retain its independence within the Facebook ecosystem. He pledged that there would be no pressure to monetize the platform, allowing it to continue operating as it had before the acquisition. However, history has shown that Facebook’s promises regarding privacy and independence have often been overshadowed by subsequent scandals, with Zuckerberg issuing apologies but the status quo remaining largely unchanged.

Facebook’s motive for buying WhatsApp

On a blog post in 2016, whatsapp announced they will no longer charge subscription fees, meaning the one dollar fee that wasn’t properly enforced anyway would be scrapped. Which on the surface sounds great, maybe facebook really do just care about connecting the world and they’re happy to make a huge loss on whatsapp and just not monetize it at all. But if we step out of dreamland and come back to reality, the truth becomes a lot clearer about why facebook really bought whatsapp and how they’re monetizing it.

Unveiling the underlying motive, it becomes evident that Facebook’s primary interest in acquiring WhatsApp lay in its extensive user base and the treasure trove of data associated with it. As one source astutely points out, Facebook operates as a surveillance-based enterprise, arguably the largest in human history. The more user data Facebook possesses, the greater its power becomes. WhatsApp, with its vast user base exceeding one billion people, provided Facebook with valuable behavioral data, contact lists, and a wealth of personal information. This acquisition was seen as the missing link for Facebook, as it granted access to phone numbers, effectively bridging the gap between the offline and online worlds of Facebook users. Furthermore, WhatsApp’s dominance in developing nations, where Facebook’s native messaging service lacks popularity, presented an exceptional growth opportunity for the social media giant. Consequently, Facebook opted to eliminate the one-dollar fee, recognizing that attracting new users into their ecosystem would prove more lucrative than charging a nominal annual fee. The value of user data far surpasses a mere dollar per year, as it enables Facebook to combine and analyze various data points from multiple sources, creating comprehensive user profiles. Armed with these detailed profiles, Facebook can target advertising more effectively, making it effortless to sell products and services to their vast user base. Removing fees removes barriers, facilitating expansion and the ultimate goal of connecting the entire world through their interconnected services.

Facebook’s acquisition of WhatsApp also served a defensive purpose: eliminating potential competition. Rumors circulated that the WhatsApp founders had been courted by Google, who sought discussions at their Mountain View headquarters. Alarmed by this prospect, Mark Zuckerberg swiftly intervened, making the WhatsApp team an offer they could not refuse, effectively thwarting any possibility of a competing acquisition. This tactic is not unfamiliar to Facebook, as they consistently employ such strategies to retain control and monopolize attention in the digital landscape.

While the financial performance of WhatsApp remains undisclosed to the public, it is evident that the platform is not currently profitable, and perhaps never has been. However, since its acquisition by Facebook, direct monetization has taken a backseat. Facebook’s primary focus lies in amassing a vast user base and the associated data. As one source astutely argues, this strategic move brings Facebook’s tentacles closer to billions of people, and with a market of such magnitude, the social media giant is bound to discover ways to eventually monetize WhatsApp. Yet, one may question Zuckerberg’s statement that WhatsApp would remain independent and would not share information with Facebook. Should there be any concerns regarding user privacy?

Brian Acton’s Turbulent Relationship with Facebook

In 2017, Brian Acton clashed with Mark Zuckerberg over WhatsApp’s monetization strategy and Facebook’s plans to share user data from WhatsApp. Acton’s conviction and unwillingness to compromise on privacy led him to part ways with Facebook, relinquishing an estimated $850 million in unvested stock options. This marked a turning point in Acton’s journey and laid the foundation for his subsequent actions.

A Pure Idealized Form of WhatsApp Determined to counter Facebook’s approach, Acton invested $50 million of his own money into launching Signal. This rival messaging app, similar to WhatsApp in features but distinct in its non-profit nature, prioritized security and privacy. Acton aimed to recreate the original essence of WhatsApp, emphasizing user-centric principles that had made it a global success.

Before WhatsApp, Acton had attempted to secure a job at Facebook but faced rejection. Undeterred, he channeled his expertise into developing his own messaging app, WhatsApp. In a remarkable twist of fate, Facebook eventually acquired WhatsApp for an astounding $19 billion, with Acton continuing as a Facebook employee.

2.2 The Falling Out: Clash Over Encryption The discord between Acton and Facebook reached a tipping point when executives sought to weaken WhatsApp’s encryption to facilitate monetization efforts. This move alarmed Acton, as it compromised the security and privacy of millions of users. Consequently, he chose to sever ties with Facebook, resolute in his commitment to safeguarding user data.

Utilizing funds from the WhatsApp sale, Acton embarked on a mission to challenge Facebook and WhatsApp by creating a new messaging app. His venture, Signal, aimed to provide a secure and private alternative to the dominant social media giants. Acton’s decision to forgo substantial financial gains demonstrates his unwavering dedication to his principles.

Deceptive Practices and Misleading Claims

In May 2017, the European Commission fined Facebook €110 million for misleading statements during the acquisition of WhatsApp. Facebook had inaccurately asserted that it was technically impossible to merge user information from WhatsApp and Facebook. Subsequently, it was revealed that WhatsApp had been sharing user data with Facebook for several years, including phone numbers for targeted advertising.

As Acton distanced himself from WhatsApp and Facebook, doubts arose regarding the strength of WhatsApp’s encryption. Some experts believe that WhatsApp’s encryption might not be as secure as it claims to be, raising concerns about the privacy of users’ conversations. These revelations only heightened Acton’s resolve to provide a more reliable and secure messaging platform.

The Clash of Privacy and Profitability

In recent years, the voices of discontent from former Facebook employees have grown louder. Brian Acton, one of the co-founders of WhatsApp, openly admitted, “I sold my users’ privacy. I made a choice and a compromise, and I live with that every day.” Acton’s revelation sheds light on the ethical dilemmas faced by those involved in the acquisition. Moreover, Chamath, the former head of growth at Facebook, expressed concerns about the impact of their tools on society, stating, “we’ve created tools that are ripping apart the social fabric of how society works.” This article delves into the clash between Facebook’s advertising-driven business model and WhatsApp’s commitment to user privacy, exploring the consequences of their eventual union.

Facebook’s acquisition of WhatsApp was a highly significant move, both in terms of financial value and strategic implications. With Facebook being one of the world’s largest advertising networks, it heavily relies on the extensive user data it collects to fuel its advertising business. On the other hand, the founders of WhatsApp, staunch privacy advocates, despised the idea of incorporating ads into their platform. Consequently, the acquisition set the stage for an inevitable clash between Facebook’s profit-driven agenda and WhatsApp’s commitment to protecting user privacy.

While the clash between Facebook and WhatsApp seems apparent in hindsight, it’s crucial to understand the motivations behind the acquisition. The WhatsApp founders were presented with a staggering $19 billion offer for an app that was not even profitable at the time. In this context, it becomes necessary to contemplate the ethical dilemma they faced. Selling WhatsApp to Facebook would bring immense financial gains, but it also meant compromising the very principles they had championed as privacy activists. The question arises: would anyone turn down such an unprecedented offer?

How WhatsApp is Expanding Its Monetization Strategies

In the ever-evolving world of technology, WhatsApp has been an integral part of our daily lives. Initially, they relied on a mere $1 fee for their services, but as time progressed, their business model shifted towards securing investments and ultimately reaping substantial benefits from their acquisition by Facebook. With Facebook’s ownership, one might wonder how WhatsApp generates revenue at present. Does it solely rely on data collection, sharing it with Facebook and its affiliates, and then leveraging it to drive sales? Contrary to this belief, WhatsApp has devised another innovative approach to monetize its platform – introducing WhatsApp Business.

WhatsApp Business is a service aimed at facilitating seamless communication between businesses and customers while providing dedicated customer support. This initiative has already caught the attention of prominent tech giants like Netflix and Uber, who have started piloting the service. The primary revenue stream for WhatsApp Business lies in its unique pricing structure. Businesses are charged if they fail to respond to customer queries within a 24-hour window, effectively incentivizing prompt replies. Although this strategy holds promise, it is crucial to acknowledge that most users have yet to explore this service, making it unlikely to single-handedly drive WhatsApp’s profitability in the immediate future.

In the wake of the elimination of the $1 fee, WhatsApp now finds itself confronted with the very obstacles it sought to avoid. The absence of a subscription fee raises questions about the platform’s sustainability and prompts the need for alternative monetization avenues. To address this, WhatsApp has announced plans to introduce advertisements within the status section of the application. However, it might be prudent for them to first remove the previous ‘Why we don’t sell ads’ post from the WhatsApp blog, as it seems contradictory in light of their evolving monetization strategies.

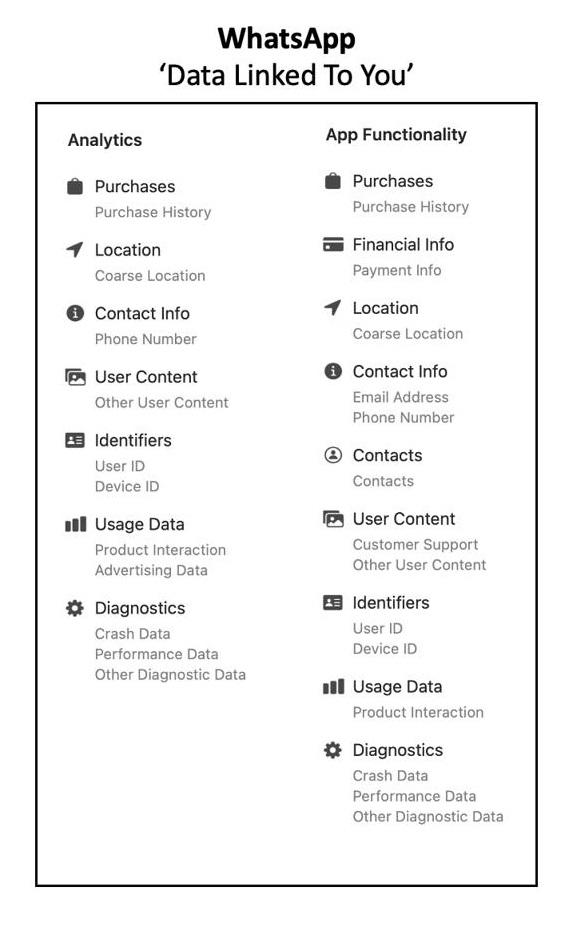

WhatsApp’s contribution to Facebook extends beyond its direct monetization potential. The true value lies in the data it generates and the seamless integration it offers across platforms. While the notion of enhanced monetization through WhatsApp garners attention, it is imperative to recognize the underlying data integration between WhatsApp, Facebook, Instagram, and other services.

Apple’s Disclosure Requirements and WhatsApp’s Response

Early in 2021, WhatsApp faced a wave of negative publicity due to concerns arising from Apple’s new disclosure requirements. This compelled WhatsApp to inform users about the data points shared with businesses and third parties. The data involved various aspects such as phone numbers, profile pictures, names, login activity, contact lists, purchase details, financial information, mobile service provider information, IP addresses, and location data.

WhatsApp initially mandated users to accept these terms by February 8th, with a threat of app suspension for non-compliance. However, in response to user complaints, they extended the acceptance deadline to May 15th, aiming to mitigate the backlash. Strikingly, this update merely clarified WhatsApp’s existing data-sharing practices rather than introducing new policies. Nevertheless, the public announcement of these practices prompted users to question their trust in WhatsApp.

When confronted with the question of trust, many users, particularly those mindful of privacy, expressed skepticism towards WhatsApp. Reddit discussions on the topic revealed a lack of trust among users, with top comments reflecting a resounding “No” to trusting the platform. Some even compiled specific reasons to avoid using WhatsApp, with a primary focus on data sharing with Facebook. However, the network effect poses a significant challenge for alternative platforms like Signal, as users hesitate to switch unless their social circles adopt the same service.

The ubiquitous nature of WhatsApp within people’s lives creates a dilemma between maintaining privacy and staying connected with friends and family. As one user lamented, the platform’s extensive integration compelled them to make a choice: privacy or interpersonal connections.

Data Collection: A Widespread Industry Practice

While this article addresses WhatsApp and Facebook’s data practices, it is important to note that data collection is a prevalent industry-wide practice, rather than a conspiracy exclusive to these companies. Many individuals perceive targeted ad delivery, facilitated by data collection, as a reasonable trade-off if transparency exists. Companies such as Google and Facebook enable free access to platforms like YouTube and social media, respectively, by leveraging user data.

Comparatively, WhatsApp’s data collection practices may not be as invasive as those employed by local stores’ loyalty programs or website cookies, which track purchasing behavior and online browsing habits. It is intriguing to ponder why individuals willingly divulge substantial personal information in exchange for free services.

1 Comment. Leave new

[…] had to have back surgery, the discussions got delayed. In that time, Mark Zuckerberg swooped in and bought WhatsApp for 19 billion dollars. And something the possibility of Tencent buying WhatsApp prompted Zuckerberg […]