Have you ever pondered why countries are unable to print more money to alleviate their debts, address homelessness, reduce unemployment, or tackle other societal issues? Although this question may initially appear peculiar, it is one that many individuals are hesitant to ask openly. Nonetheless, the concept behind it is genuinely intriguing.

In a single word, the answer can be summarized as “inflation.” Inflation refers to the persistent and substantial increase in the general price level caused by an expansion of the money supply, which in turn diminishes the value of currency. To better grasp this concept, let us delve into the very nature of money.

Understanding the Nature of Money

While it may seem self-evident, it is crucial to recognize that money possesses no intrinsic value. Its worth lies solely in its ability to facilitate transactions. On a deserted island, for instance, money would be rendered utterly useless. The value of money is a societal construct, a manifestation of collective belief known as the Tinkerbell Effect, as expounded by Vsauce.

The Tinkerbell Effect elucidates how something exists solely because we collectively deem it to exist. The same applies to money. If society were to abruptly lose faith in the value of money, it would become worthless.

However, this was not always the case. Money has played a role in human civilization for millennia, initially taking the form of commodity money. Items of tangible value, such as salt, spices, horses, and weapons, were used for trade. Additionally, precious metals like gold and silver, despite lacking intrinsic value, were universally accepted as a medium of exchange due to their scarcity.

Subsequently, the concept of representative money emerged. Since carrying around physical assets posed practical challenges, representative money offered a more convenient solution. Individuals would entrust their gold to a bank, receiving a certificate as proof of ownership. These certificates could then function as currency, with the holder having the ability to redeem the gold at any time.

Today, the prevalent monetary system across the world is fiat money. Fiat money relies on the faith and trust bestowed upon the governing authorities regarding the value of the currency. Taking the United States as an example, a relatively young nation, it has traversed through all three monetary systems within a span of 200 years.

In 1792, with the termination of European currency usage, the Coinage Act of 1792 marked the inception of the US dollar. Initially, the US dollar took the form of commodity money, comprising coins crafted from real gold, silver, and copper. The value of these coins was equivalent to the metal content they contained.

The country then transitioned to a combination of commodity and representative money with the enactment of the 1900 Gold Standard Act. Dollar bills were issued by the government, redeemable for gold upon request. The Gold Standard, widely adopted at the time, served as a representative form of money, enabling accurate exchange rate calculations between countries. For instance, if one gram of gold cost £1 in Britain and $1.50 in America, it became evident that £1 equaled $1.50.

This marked the phasing out of gold coins and the removal of silver from other coins, effectively concluding the era of commodity money.

The Impact of Abandoning the Gold Standard on Fiat Money

The abandonment of the Gold Standard by Richard Nixon in 1971 marked a significant shift in the United States’ monetary system. The transition to fiat money introduced a new era where currency value was no longer backed by gold or any other tangible asset.

The Effects of Increased Money Supply

One of the fundamental principles of economics suggests that an increase in the money supply leads to a decline in demand, subsequently resulting in a decrease in price. In the case of fiat money, as more currency circulates within the economy, the value of each dollar decreases. Consequently, this enables other countries to acquire more dollars in exchange for their own currency.

Also Read: John D. Rockefeller – The Richest Man in Modern History

Supply and Demand Dynamics

Analyzing the relationship between supply and demand using a graphical representation helps illustrate the impact of increased money supply on prices. When there is a surplus of money within the economy, the demand curve for goods and services shifts. However, without a corresponding increase in economic output, this surge in demand inevitably leads to a rise in prices.

To better comprehend this concept, let’s consider an analogy. Imagine four individuals stranded on a desert island, each possessing ten pieces of fruit. All fruits are deemed equal in value. Now, assume they stumble upon an entire forest filled with apple trees. As the supply of apples increases, their nominal value rises. However, due to the influx of supply, the actual value of an apple diminishes. Consequently, the cost of one banana may soar to the equivalent of ten apples since demand for apples is low while demand for bananas remains high.

In this analogy, the individuals represent different countries, the fruits symbolize their respective currencies, and the apple tree signifies the introduction of printed money into the economy.

Historical Examples of Printing Money Gone Wrong

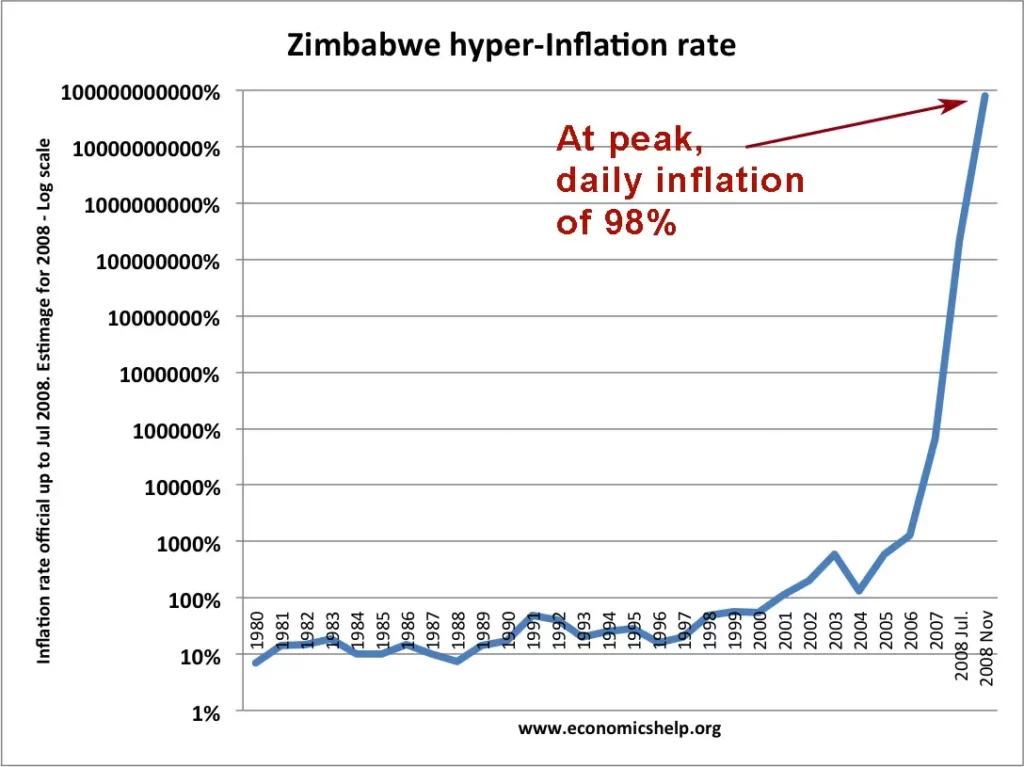

The drawbacks of excessive money printing are not solely grounded in economic theory but have been substantiated by numerous real-world instances throughout history. One notable example is Zimbabwe, where the country experienced a severe inflationary crisis in 2008 due to the excessive printing of money. President Robert Mugabe’s ill-advised decisions during the economic downturn prompted the printing of more currency to meet government expenditure. Consequently, inflation soared to unprecedented heights, peaking in mid-November 2008.

To fully grasp the magnitude of the situation, it is essential to provide some context. Inflation rates in the United States typically hover around 2%, with economists generally agreeing that levels between 1-3% are optimal. First-world countries’ inflation rates today vary between 0-5%. When inflation levels surpass 50%, a country is considered to have entered a state of hyperinflation.

Keeping these benchmarks in mind, Zimbabwe experienced hyperinflation that reached an astonishing 6.5 sextillion percent at its peak. To put this number into perspective, it consists of 22 digits. The situation deteriorated to such an extent that prices doubled every 24 hours.

In a desperate attempt to address the crisis, the Zimbabwean government resorted to printing money with increasingly higher denominations. They also attempted to mitigate the problem by revaluing the Zimbabwean dollar three times, resulting in the introduction of four different types of currency, each with its own ISO code. Prior to the final redenomination, the government was printing 100 trillion-dollar bills.

The severity of the situation became evident as individuals were forced to transport wheelbarrows filled with cash merely to purchase a loaf of bread. At one point, the government even deemed inflation illegal, leading to the arrest of individuals who dared to raise prices.

Exploring the Devastating Effects of Inflation

In 2009, Zimbabwe made the difficult decision to abandon its national currency, the Zimbabwean dollar. Since then, the country has been relying on alternative currencies such as the US dollar, Pound Sterling, and Euro.

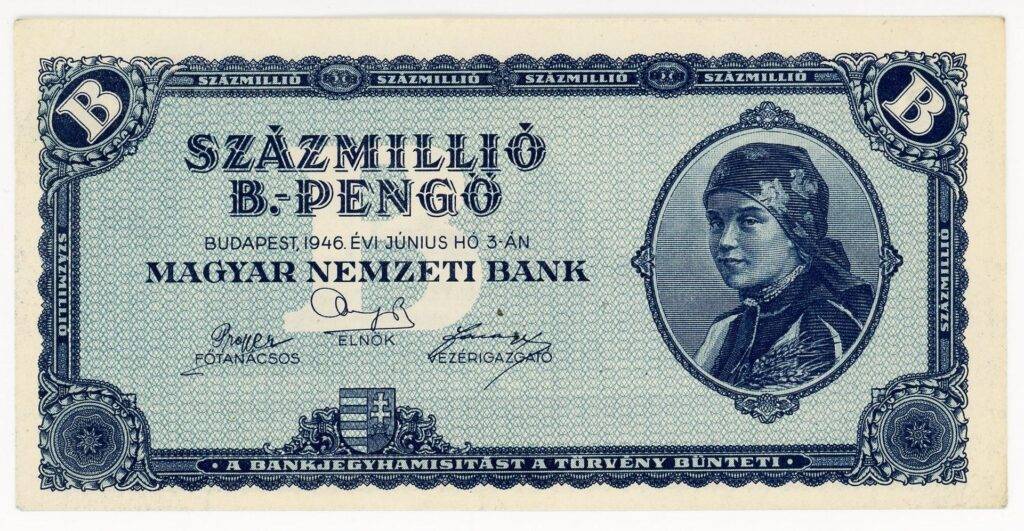

Prior to the hyperinflation, the exchange rate of the first Zimbabwean dollar stood at approximately 1.25 US dollars. To grasp the magnitude of the crisis, consider the astonishing value of a 100 trillion-dollar bill at that exchange rate. It would have been worth more than the global money supply, twice over. Despite this mind-boggling scenario, Zimbabwe’s hyperinflation is only regarded as the second worst in history, with Hungary’s inflation crisis of 1946 claiming the top spot.

Hungary: A Historic Case of Inflation

Hungary’s hyperinflation reached its peak in July 1946, surpassing Zimbabwe’s inflation rates. Hungary’s highest monthly inflation stood at a staggering 41.9 quadrillion percent, causing prices to double every 15 hours. In contrast, a country experiencing a healthy inflation rate of around 3% would witness prices doubling every 23 years. To combat hyperinflation, Hungary introduced the bil-pengo (short for billion pengo) as their currency during this period. Notably, Hungary also holds the record for issuing the highest denomination banknote ever—the 100 million bil-pengo note, equivalent to 100 quintillion pengo.

The Complexity of National Debt

Understanding national debt goes beyond a simple notion of owing money. It is a complex concept that distinguishes itself from personal debt. To illustrate this, let’s examine the case of the United States, a nation with the highest national debt, which currently amounts to around 17 trillion dollars. While China is often associated with holding the most significant portion of US debt, the reality is somewhat different.

Out of the total debt, China’s share accounts for merely 8%. The majority of the debt is actually owned by various US government entities like Social Security and the Federal Reserve. Additionally, 30% of the debt is owned by US citizens. Hence, China cannot simply demand $1.2 trillion from the White House, as their ownership constitutes only a fraction of the total debt.

Treasury Bonds and Financial Stability

The US Department of the Treasury plays a crucial role in managing the country’s debt by issuing treasury bonds. These bonds are available for purchase, and the government pays interest on them annually. When the bonds reach maturity, the government repurchases them from the bondholders.

While it is possible for a country to default on its debt, the United States is generally regarded as a low-risk investment due to the wide acceptance and trustworthiness of the US dollar. Furthermore, the US Constitution explicitly prevents the country from defaulting on its debt.

The Value of Money and Limitations on Printing

It is essential to acknowledge the inherent value of money and the limitations on its production. Simply put, if money were as abundant as leaves on trees, it would lose its value. Governments cannot print unlimited amounts of money without facing dire consequences. This principle emphasizes the significance of responsible fiscal policies and the importance of maintaining the integrity of a nation’s currency.