Currently the Yuan Vs Dollar topic is a trending topic in the financial and geopolitical world. The world of international finance and geopolitics has long revolved around the United States and its powerful tool: the US dollar. Located just twenty minutes east of the White House in Langley, Virginia, the CIA headquarters stands as a symbol of American financial power. Furthermore, seventy minutes southwest lies the Swift data center, the hub that meticulously records global cross-border transactions. These strategic sites, in close proximity, are not merely coincidental but representative of the interconnection between finance and geopolitics. For almost eight decades, American financial dominance has been a crucial geopolitical weapon, with the US dollar acting as its main component.

The global currency market plays a crucial role in international trade, investments, and financial transactions. For decades, the US dollar has enjoyed unparalleled dominance as the world’s reserve currency, granting the United States significant economic advantages and influence. However, China‘s rapid economic growth and expanding global influence have prompted it to envision a future where the yuan assumes a more prominent role, potentially challenging the dollar’s supremacy.

Yuan vs Dollar: Understanding the Key Differences

In today’s globalized world, currencies play a crucial role in international trade and finance. Among the various currency pairs, the Chinese yuan (CNY) and the United States dollar (USD) stand out as two of the most significant. Understanding the differences between these two currencies is essential for businesses, investors, and individuals alike. In this article, we will delve into the nuances of the yuan and the dollar, highlighting their distinctions and shedding light on their impact on the global economy.

The Dominance of the US Dollar in the Global Economy

To understand the present-day status of the US dollar, we must first journey back to the aftermath of World War II. In 1944, world leaders gathered in Bretton Woods, New Hampshire, to establish a new global financial framework. The resulting Bretton Woods System, led by the United States, sought to promote economic stability and facilitate international trade.

Under this system, participating countries pegged their currencies to the US dollar, which, in turn, was linked to gold. This arrangement provided confidence and stability, bolstering the US dollar’s prominence and reinforcing its role as the linchpin of the global financial system.

Beyond the Bretton Woods System, the US dollar’s dominance owes much to the economic supremacy of the United States itself. Following World War II, the United States emerged as the world’s leading economic powerhouse, with a robust industrial base, technological advancements, and a thriving consumer market.

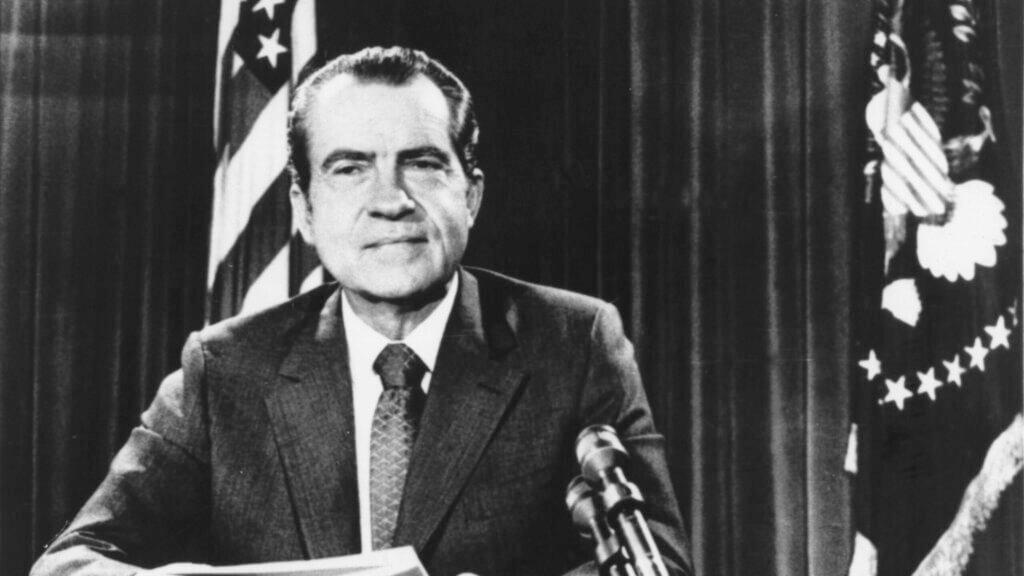

Additionally, the 1970s marked a significant turning point in the dollar’s international standing. In 1971, President Richard Nixon suspended the convertibility of the US dollar into gold, effectively ending the gold standard. This move paved the way for the era of fiat currencies, with the US dollar at the forefront.

Simultaneously, a new phenomenon known as the petrodollar system emerged. As the largest consumer of oil, the United States forged agreements with oil-producing nations, ensuring that oil would be priced and traded exclusively in US dollars. This arrangement solidified the dollar’s position as the global reserve currency and created an insatiable demand for US dollars, further strengthening its dominance.

The Shift Towards Alternative Financial Infrastructures

The process of de-dollarization is rapidly expanding through bilateral, multilateral, and institutional arrangements. China, in particular, is leading the charge in challenging the nature of the dollar matrix. In the realm of geopolitics, it is imperative to reduce dependence on others, as even the most reliable alliances can falter when faced with uncertainty. China has been actively forging deals with various nations, aiming to distance itself from the US dollar. One notable example is the recent agreement between China and Brazil, which enables trade to be conducted using their respective currencies. Notably, this de-dollarization initiative is spearheaded by former Brazilian President Dilma Rousseff, who currently chairs the New Development Bank. This institution seeks to provide loans in local currencies, with nineteen states expressing their interest in joining the program.

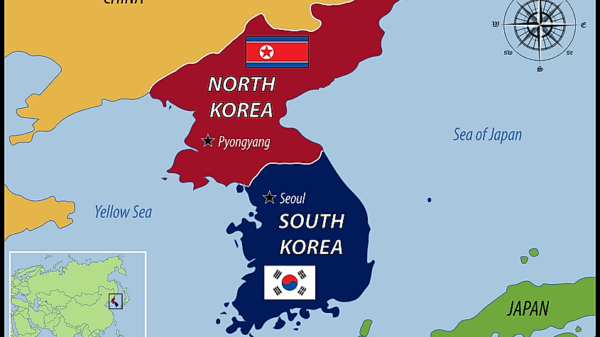

Money, as a social institution, holds immense power to influence and command others. Historically, money was intrinsically tied to precious metals. However, the value of money extended beyond its metal content, deriving strength from the state that endorsed it within its market. In the anarchic global system, the absence of a world state necessitates the presence of national monetary systems. As a result, global money regimes reflect the interests of the major currency-issuing powers. Since 1944, the United States has centralized monetary power, while Western European and Eastern European powers found themselves falling on opposite sides of the Iron Curtain. Leveraging its creditor power, Washington exerted influence over Britain and France by opening their imperial trading blocks. Post-war reconstruction loans were contingent upon importing American goods and granting the United States veto power within lending institutions such as the IMF and the World Bank. The establishment of a fixed exchange rate system convertible with gold further solidified the global monetary order. However, mounting NATO expenditure, coupled with military engagements in Korea and Vietnam, eventually caused the United States’ international payments to plunge into deficit territory.

America’s Payments Deficit and the Abandonment of Gold

During 1964, America’s payments deficit was primarily driven by overseas military spending. Despite recognizing the issue, vested interests and the belief in the indispensability of such expenditures for national security hindered Washington from taking action. As a consequence, the convertibility of dollars into gold became increasingly strained. The volume of circulating dollars exceeded the legal limit, surpassing Washington’s gold stock. In August 1971, the Nixon Administration made the significant decision to abandon the gold standard and devalue the dollar by 10 percent.

The abandonment of gold unexpectedly presented Washington with a geopolitical advantage. Foreign central banks were no longer able to check the United States by exchanging dollars for gold, as doing so would render their substantial dollar holdings worthless. Repudiating the dollar’s legitimacy was not a viable option for them. Consequently, foreign central bankers had no choice but to recycle their dollars into interest-bearing U.S. Treasury securities. Failing to do so would result in a dollar oversupply, granting American firms a competitive advantage over European industry.

Untethered from gold, Washington could now pursue overseas military spending without constraints. Dollars sent overseas were exchanged for local currency, which flowed into foreign central banks and subsequently cycled back to the United States through treasury bill purchases. This circular flow had no theoretical limit, effectively acting as a perpetual rollover of American debt. Consequently, American strategists could establish a vast network of 800 military bases, encircling countries like Russia and China, knowing that the money spent would eventually return to the United States. The fear of an international monetary breakdown prevented other states from challenging this arrangement.

Further bolstering dollar dominance was a deal struck with Saudi Arabia in 1974. Under this agreement, Saudi Arabia would sell oil exclusively in dollars and reinvest the proceeds into U.S. treasuries. Combined with America’s agricultural dominance, this arrangement provided the means to exert unilateral dollar sanctions, effectively strangling hostile powers’ access to food and energy imports. However, this system was viewed as inequitable by geopolitical rivals who sought a new international economic order despite lacking the necessary hard power to enforce it.

De-Dollarization and China’s Role

Ironically, American businesses inadvertently facilitated de-dollarization when they offshored their production to China in pursuit of lower wages. While Washington believed this move increased profit rates, it failed to recognize that true national wealth lies in productive capacity. As North America deindustrialized, Washington’s growing import dependency and China’s rapid industrial development became a source of geopolitical tension.

China, while wary of funding its own encirclement through the dollar system, remained in a delicate balance due to its exposure and its holdings of one trillion dollars of American debt. However, it was China’s partners that ultimately became the catalysts for de-dollarization.

In recent years, the world has witnessed a significant rise in de-dollarization efforts, as countries seek to reduce their reliance on the US dollar and its associated risks. This shift has been fueled by escalating American sanctions and designations, starting with Russia’s annexation of Crimea and extending to Chinese technology firms like Huawei. The impact of these measures has prompted nations to explore alternative avenues to safeguard their financial interests.

The Erosion of Trust & It’s Impact on Dollar

Following Washington’s freezing of Iranian, Venezuelan, and Afghan sovereign assets, trust between nations began to deteriorate rapidly. The tipping point arrived in 2022 when the United States seized a staggering $300 billion in Russian assets and proposed channeling the funds towards Ukraine’s reconstruction. This controversial decision, more than any other, marked the end of dollar hegemony.

It became clear that countries would be hesitant to engage in financial transactions with a state that arbitrarily seizes foreign assets. The bedrock of international financial relationships is trust, even in the face of political tensions. With trust eroded, countries such as China have initiated de-dollarization efforts to shield themselves from Russia-style sanctions. By engaging in bilateral and multilateral deal-making, China manages its decoupling from the dollar while extending an economic lifeline to nations like Russia and Iran.

Yuan’s Internationalization

Currency internationalization is the process by which a country’s currency expands its reach and becomes widely used beyond its borders for international trade, investment, and financial transactions. This process brings several benefits to the issuing nation, including increased economic influence, reduced dependency on other currencies, and improved stability of domestic financial markets. For China, the internationalization of the yuan represents a strategic move aimed at solidifying its position as a global economic powerhouse.

To facilitate the internationalization of the yuan, China has taken significant steps to develop offshore yuan markets. These markets exist outside the mainland and allow foreign entities to trade, hold, and settle transactions in yuan. The most prominent offshore yuan market is located in Hong Kong, known as the Hong Kong Offshore Yuan Market (CNH).

The establishment of the CNH market has created a platform for global investors to access yuan-denominated assets and conduct yuan-based transactions. This development has greatly facilitated cross-border trade between China and other nations, while also enhancing the liquidity and credibility of the yuan as an international currency.

In addition to the development of offshore yuan markets, China has actively pursued currency swap agreements with other countries. Currency swaps are bilateral agreements between central banks that enable the exchange of domestic currencies for the purpose of facilitating trade and investment. These agreements serve to reduce reliance on third-party currencies, such as the U.S. dollar, and promote direct currency-to-currency transactions.

China has entered into numerous currency swap agreements with countries worldwide, including major economies like the United Kingdom, Germany, Australia, and Japan, among others. These agreements provide a solid foundation for expanding the use of the yuan in international trade settlements, boosting confidence in the currency and strengthening China’s economic ties with partner nations.

The increasing internationalization of the yuan carries significant implications for the global financial landscape. As the yuan gains prominence, it challenges the long-standing dominance of the U.S. dollar as the world’s primary reserve currency. This shift has the potential to reshape the dynamics of international trade, investment flows, and global financial stability.

Furthermore, the internationalization of the yuan opens up new opportunities for businesses and investors to diversify their currency holdings and tap into the growing Chinese market. With China being the world’s second-largest economy, the expansion of yuan-denominated assets and financial products presents attractive prospects for those seeking to participate in the country’s economic growth.

The Ripple Effect: Smaller States Embrace De-Dollarization

China’s pursuit of de-dollarization has emboldened smaller states to follow suit. Even the U.S. Treasury has acknowledged this growing trend. Central bank dollar reserves are witnessing a proportional decline, while countries like Russia, China, India, and the EU are actively establishing Swift Alternatives such as SPFS, CIPS, INSTEX, and SFMS.

For instance, China has recently forged a currency swap agreement with Argentina worth 130 billion yuan, equivalent to approximately $19 billion. This arrangement allows Argentina to freeze its dollar holdings to service its debts to the International Monetary Fund (IMF). Furthermore, China has brokered a landmark deal between Iran and Saudi Arabia, bolstering its diplomatic influence to match its status as the world’s leading importer of oil and petrochemicals. Saudi Arabia is now contemplating selling oil in Chinese currency, and Qatar has already settled its gas purchases in Yuan.

Over time, these arrangements could expand throughout influential groups like OPEC and the Shanghai Cooperation Organization. OPEC alone accounts for nearly 44% of global oil production, while the Shanghai Cooperation Organization contributes one-fifth of global GDP. However, the most significant coalition promoting de-dollarization is BRICS, consisting of two-fifths of the world’s population, one-quarter of its GDP, and 16% of its commerce. BRICS has unequivocally committed to the pursuit of de-dollarization.

The partnership between China and Brazil holds particular importance in the de-dollarization landscape. Given Brazil’s significant role as a commodity producer, its trade with China reached over $150 billion in 2022. In March 2023, the two countries solidified their commitment to trade in local currencies, minimizing exposure to dollar fluctuations. They intend to leverage the New Development Bank to provide one-third of loans in local currencies, facilitating more manageable debt repayments. This ambitious program has already garnered interest from 19 states seeking to join BRICS, including Argentina, Egypt, and Indonesia.

Parallel Networks and Gold

Apart from strategic partnerships and currency swaps, other developments such as the emergence of central bank digital currencies present an opportunity to establish parallel payment networks independent of dollar influence. However, as a temporary measure, gold is expected to play a pivotal role. China, in particular, has shifted its focus from treasury bill purchases to accumulating gold reserves, surpassing 1,800 tons by April 2023. This emphasis on gold signifies a broader strategy by China, which treats credit as a public utility, strategically deploying it for development and political objectives.

While the prevalence of the Chinese yuan will gradually erode the dominance of the dollar, it is unlikely to replace it as the world’s reserve currency. The status of a global reserve currency is inherently tied to the balance of power, and the emergence of multipolarity is already shaping currency regimes. The US dollar is not on the verge of disappearance, but its exorbitant privilege is undeniably waning. This shift will curtail its effectiveness as an economic weapon, placing a greater burden on America’s tax base to sustain military spending.

Navigating a Transforming Financial Landscape

The rise of de-dollarization signifies a momentous shift in global currency dynamics. Countries are actively exploring alternatives to mitigate the risks associated with the US dollar’s supremacy. As trust between nations wanes and smaller states follow the lead of major powers, the future of the international financial system hangs in the balance. While the dollar will persist, its exorbitant privilege is steadily fading. The world must adapt to a multipolar currency landscape, where cooperation, resilience, and strategic partnerships become vital for economic stability in an ever-changing world. In the words of Chinese President Xi Jinping, “Right now, there are changes the likes of which we haven’t seen for 100 years.”